EMV 3D-Secure

1.1.4 3DS 2.0 and GDPR compliance

1.1.5 PSD2 SCA exemptions and exclusions

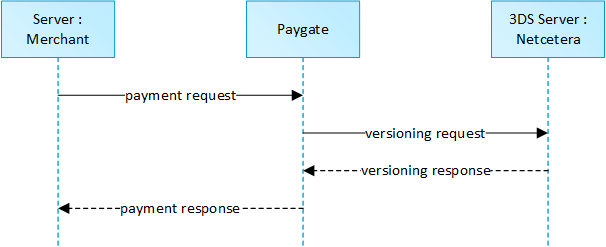

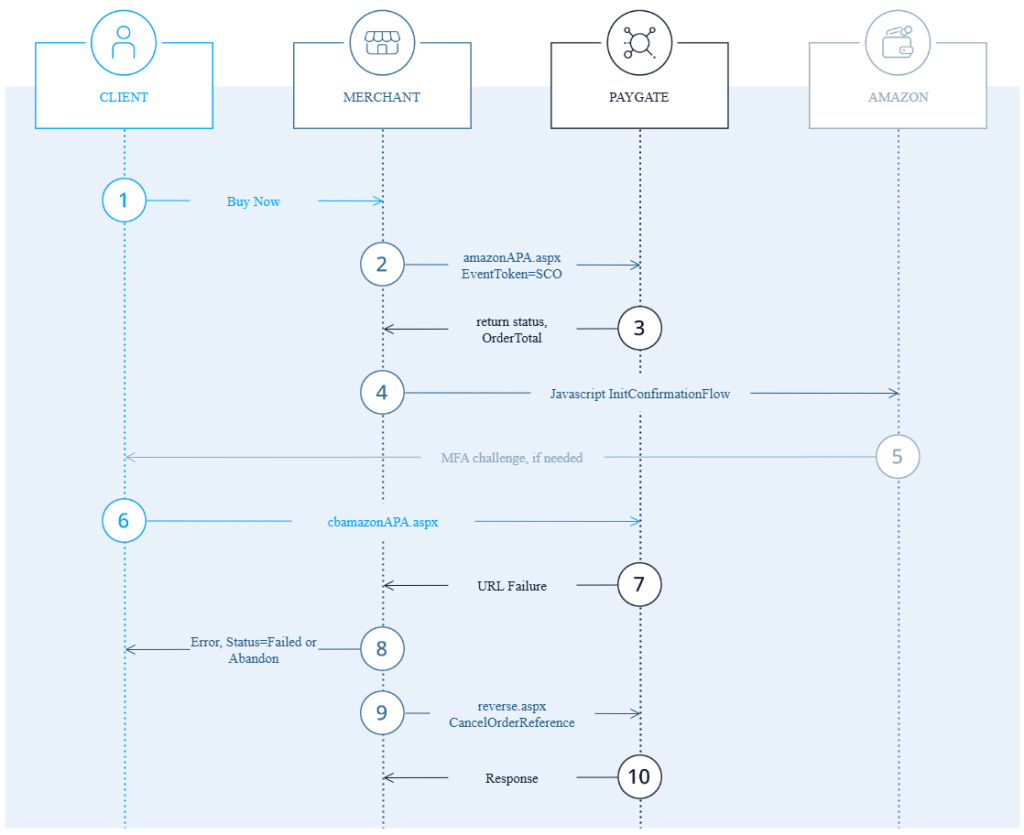

2.1.1 Simplified Sequence Diagram

2.1.3 HTTP POST to URLSuccess / URLFailure / URLNotify

2.1.4 Credit Card payments with separate authorisation

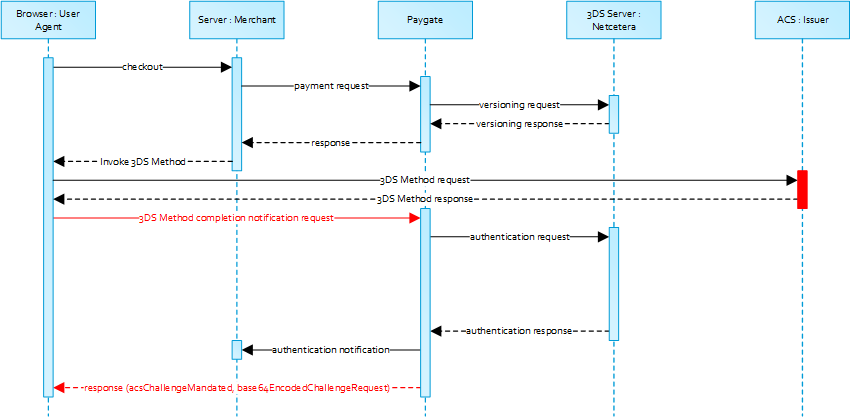

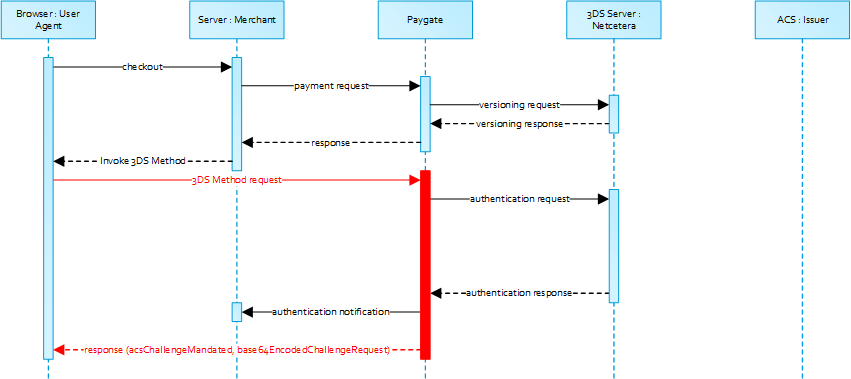

2.1.5 Extended Sequence Diagram

2.2 Server-2-Server integration

2.2.1 Card Processing – Server-2-Server integration

2.2.2 Server-2Server Sequence Diagram

2.2.4 Call of interface: general parameters

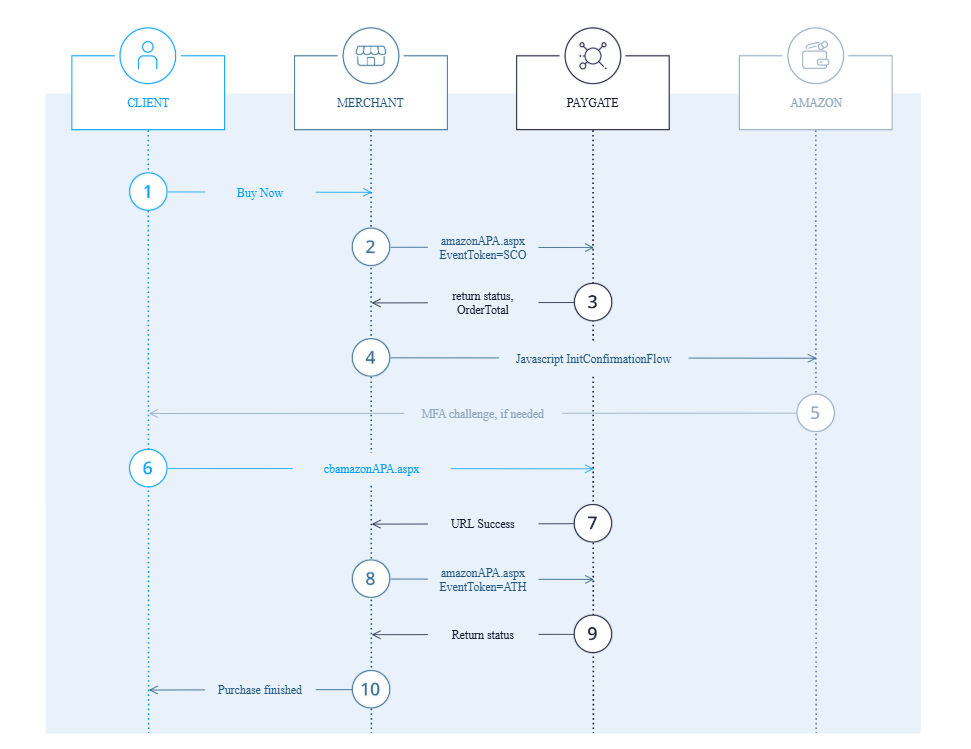

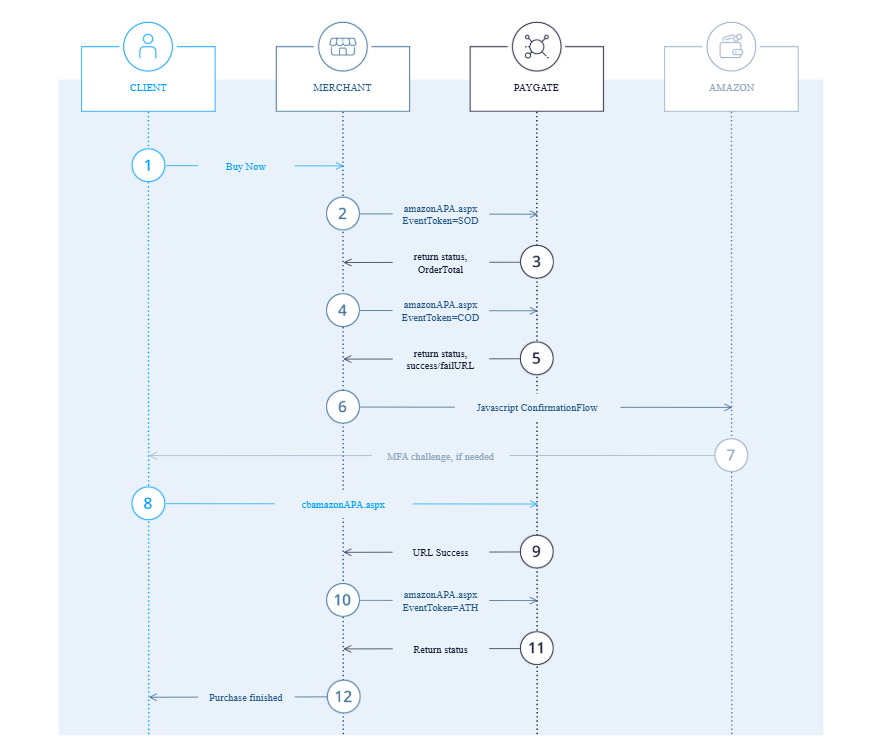

2.4 Silent Order Post (PayNow)

2.4.3 HTTP POST to URLSuccess / URLFailure / URLNotify

4.1 3DS authentication hosting

4.4 Dynamic Billing Descriptors

4.5 Mandatory and conditional required data elements for EMV 3DS

4.6 Multi-party e-commerce / Agent Mode

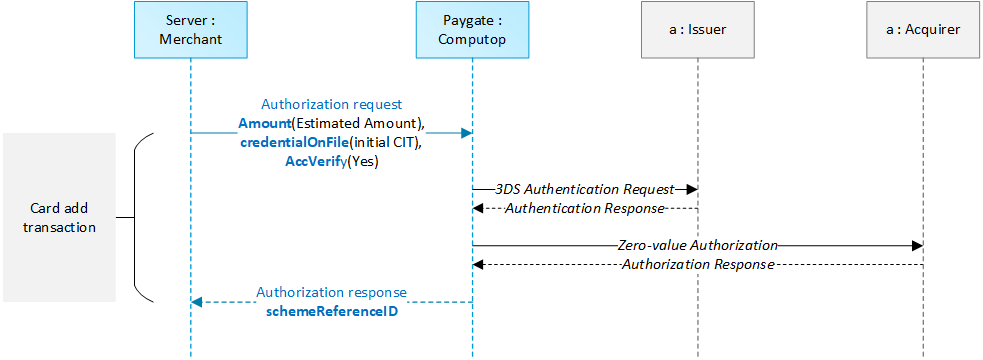

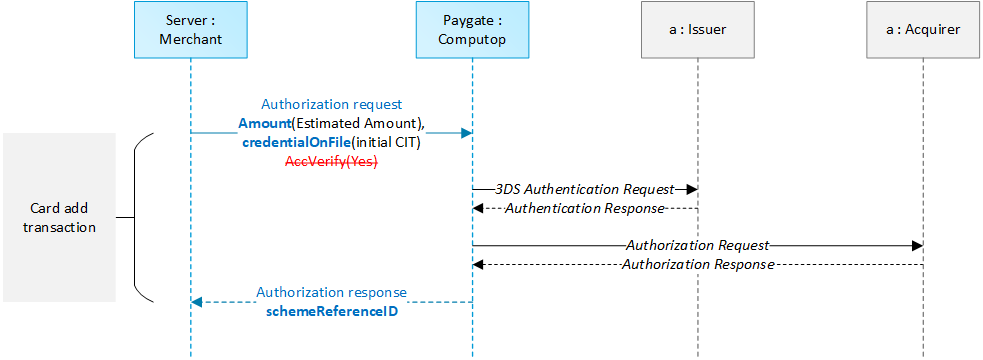

4.7 Non-payment authentications for Card Add

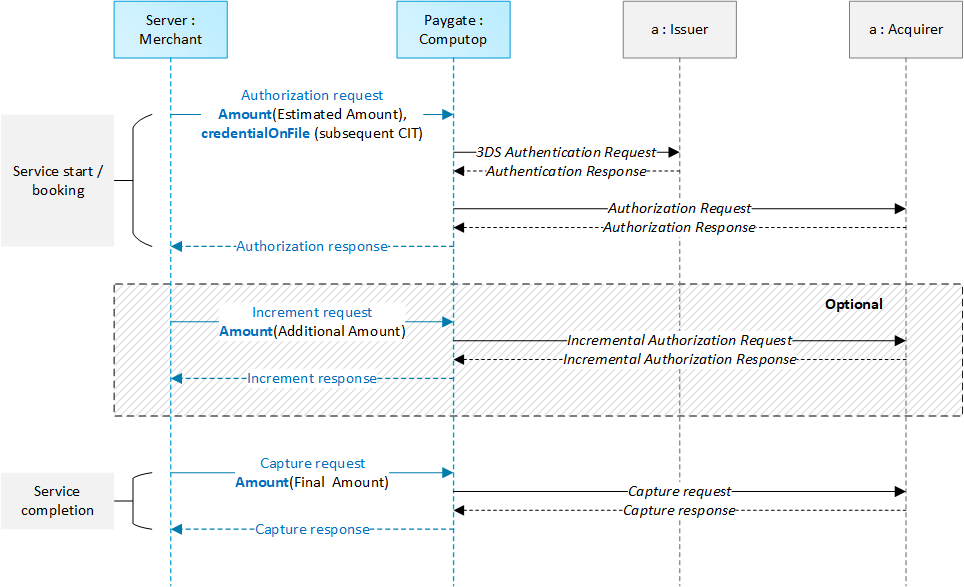

4.8.1 Real-time service via mobile app with payment after service completion

1. About 3-D Secure

1.1 Regulatory Requirements

1.1.1 EBA Mandate

The European Banking Authority (EBA) mandated that all payer who access their payment account online and initiate electronic payment transactions through a remote channel must be strongly authenticated (aka Strong Customer Authentication (SCA)) commencing September 14, 2019. The card organizations seized this opportunity to overhaul the established 3D-Secure protocol for cardholder authentication and to address several issues that curbed adoption in the market.

1.1.2 3DS 2.0

Previously, internet merchants had the choice to either present a cardholder challenge (e.g. TAN / password) or to give 3DS a pass entirely. Some adopted a dynamic approach based on PSP or own risk assessment, but many merchants valued a frictionless checkout and high conversion rates more than the potential benefits of a liability shift. The card organization’s overall strategy for 3DS 2.0 is to reduce friction through an improved cardholder experience (device awareness) and to leverage exemptions from SCA based on robust transaction risk analysis (TRA) with the ultimate goal of delivering optimal authorization performance and conversion rates. Thus, TRA is key to delivering frictionless payment experiences for low-risk remote transactions. Therefore the 3DS 2.0 protocol introduced a plethora of additional data points that can be transferred to the issuer to aid transaction risk analysis and to apply excemptions from SCA.

SCA will be required when:

- The transaction is not out of scope of the PSD2 RTS

- No PSD2 SCA exemption applies for a payment transaction

- Adding a card to a Merchant’s file (card-on-file)

- Starting a recurring payment arrangement for fixed and variable amounts, including setting the initial mandate for Merchant-Initiated Transactions

- Changing a recurring payment agreement for a higher amount (premium offering for example)

- Setup of white-listing (or viewing/amending white-lists)

- Binding a device to a Cardholder

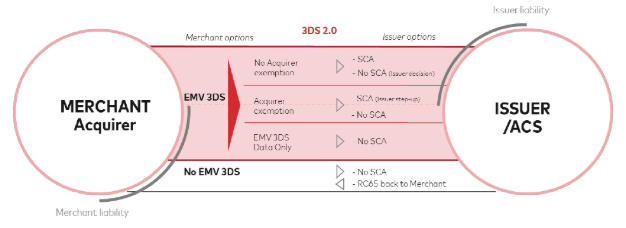

1.1.3 Liability Shift

As a rule of thumb, when cardholder authentication was performed through 3-D Secure, merchants are typically protected against e-commerce fraud-related disputes and liabiliaty shifts from the merchant / acquirer to the issuer. There are exceptions to merchant dispute protection though. In the context of 3DS 2.0 merchants are regularily not protected if granted excemptions according to PSD2 RTS were actively requested by merchant / acquirer.

The following diagram depicts options and liabilities under PSD2 RTS requirements according to MasterCard.

1.1.4 3D Secure 2.0 and GDPR Compliance

Cardholders must be provided with detailed information about how their data is collected, used and processed. This can be ensured via a Privacy Notice including at a minimum the types of data being processed, the purposes of their processing, data uses, etc. Card organizations and Issuers will not use EMV 3DS data for other purposes than fraud prevention and authentication. It excludes the usage of personal data for other purposes, such as sales, marketing and data mining (other than fraud prevention as purpose) activities.

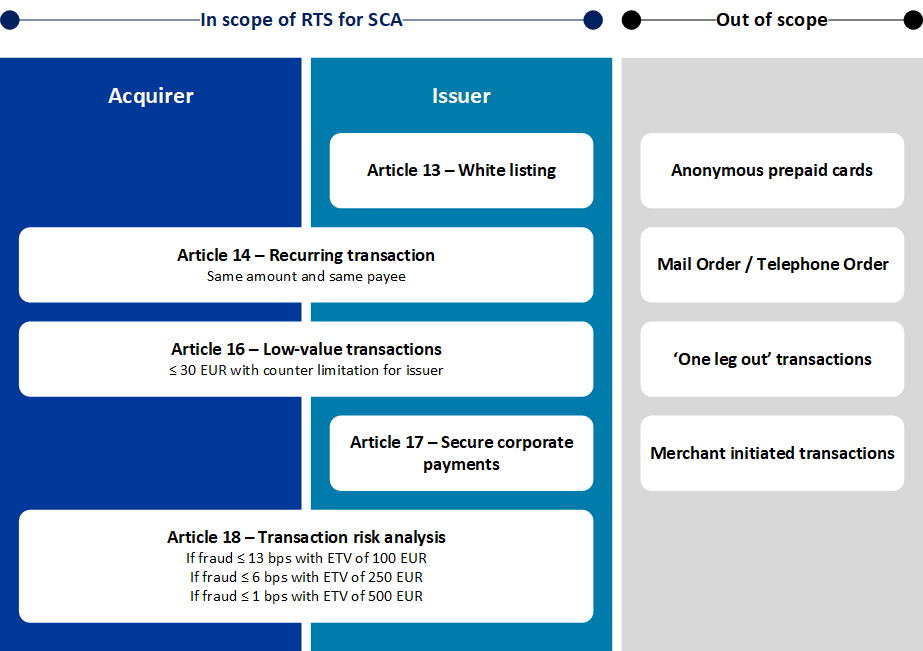

1.1.5 PSD2 SCA Exemptions and Exclusions

There are some important excemptions to SCA according to the regulatory technical standards (RTS) that may apply in various conditions which are depicted in the following digram.

1.2 The 1cs Online Payment System

1.2.1 Authentication Options

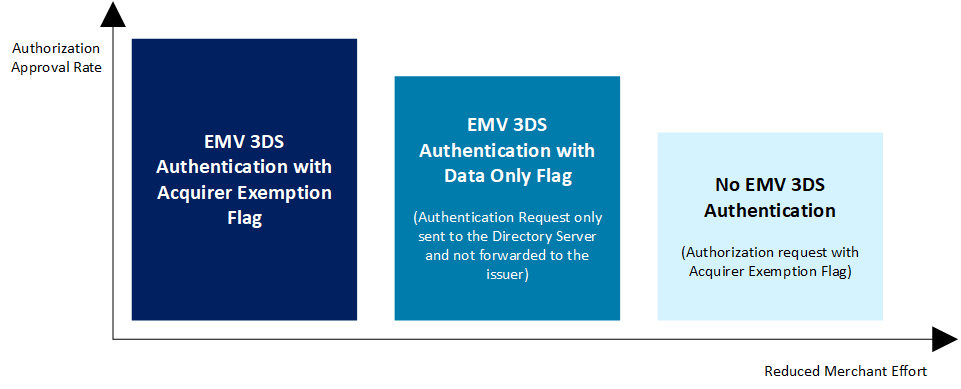

An acquirer may be allowed to not apply SCA due to to low fraud rates and TRA. For these excemptions there are various processing options available as depecited in the diagram below.

As a standard, First Cash Solution will submit (where supported) applicable excemptions through the EMV 3DS authentication flow to the issuer to achieve best possible authorization approval rates.

EBA-Op-2018-04, Paragraph 47 – Clarification on PSP (Acquirer Fraud Rates)

The fraud rate as defined in Annex A of the RTS is calculated for all credit transfer transactions and all card payment transactions and cannot be defined per individual payee (e.g. merchant) or per channel (whether app or web interface). The fraud rate that determines whether or not a PSP qualifies for the SCA exemption cannot be calculated for specific merchants only, i.e. where the payer wants to make a payment to a specific merchant and this specific merchant has a fraud risk that is below the threshold. While the payee’s PSP (acquirer) may contractually agree to ‘outsource’ its transaction risk analysis monitoring to a given merchant, or allow only certain predefined merchants to benefit from that PSP’s exemption (based on a contractually agreed low fraud rate), the fraud rate making a given PSP eligible for an exemption under Article 18 would still need to be calculated on the basis of the payee PSP’s executed or acquired transactions, rather than on the merchant’s transactions.

1.2.2 Message Version 2

To handle the amount of additional non-payment data and to maintain downward compatibility as much as possible First Cash Solution decided to version its the 1cs Online Payment System card interface via the additional data element MsgVer. The upgraded API is still based on key-value pairs but relies heavly on Base64 encoded JSON objects to aid readibility and client-side scripting.

Merchants will still be able to use our classic interface for requests even with 3DS 2.0 but there are some limitations:

- Many additional data points for issuer risk analysis are not available and thus, the frictionless ratio might be lower

- API responses and notifications do include new JSON objects to cater for 3DS 2.0 protocol specifications and require modification of existing merchant integrations

For these reasons it is highly recomended to upgrade to version 2.

1.2.3 Soft decline handling

In case a transaction is missing SCA, issuers might respond with so-called soft declines. This means that the transaction authorization request is declined by the issuer, however, the same transaction can be initiated again. The main reason for soft declines emerging in the context of 3D Secure is that issuers are not accepting SCA exemptions requested by the merchant when such is sent directly to authorization or when the merchant requests payment without authentication being carried out beforehand. The best practice is to restart the payment including 3DS. With Automated Soft Decline Handling feature, configuration based, the 1cs Online Payment System (1cs OPS) will react to the soft decline response by automatically restarting the payment forcing SCA. The 1cs OPS will then automatically create a new payment on behalf of the merchant and include 3DS flow.

IMPORTANT:

- From a user’s point of view, customers will not notice any difference and will not need to re-enter their credit card data. The whole process is managed by the First Cash Solution GmbH.

- Please note that this solution is not available for server-to-server integrations, as 1cs OPS does not have the client (browser) in control to start the 3-D Secure flow. For server-to-server integration, the merchant is responsible to re-trigger the payment with 3-D Secure flow and most important forcing the SCA challenge through the available parameter JSON threeDSPolicy (challengePreference = mandateChallenge).

1.2.3.1 Whitelisting of trusted beneficiaries

A cardholder might opt to add a merchant to a list of trusted benficiaries maintained at the issuer to excempt this particular merchant from SCA with future payments. This will usually occur during a cardholder challenge but cardholder’s might also be able to manage a list of trusted beneficiaries through their banking app for instance.

Merchants may benefit from a whitelist excemption if requested and if a cardholder challenge is not required otherwise.

Please note that whitelisting is available with 3DS version 2.2 and higher. Currently issuer most support 3DS 2.1.

Notice: Please note that whitelisting is available with 3-D Secure version 2.2 and higher. Currently issuer most support 3-D Secure 2.1.

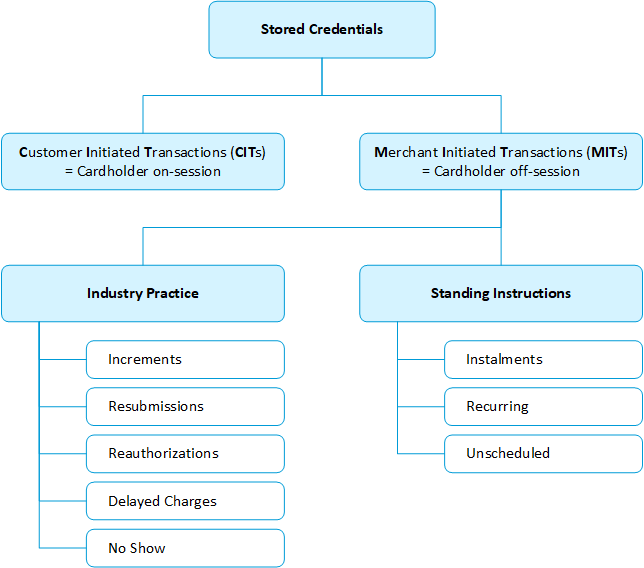

1.2.3.2 Recurring transactions

Recurring transactions are a series of transactions processed following an agreement between a cardholder and a merchant where the cardholder purchases goods or services over a period of time and through a number of separate transactions with the same amount. The initial transaction must be authenticated (i.e. cardholder initiated transaction (CIT)). Subsequent recurring payments are out of scope of RTS SCA since they are regularily merchant initiated (i.e. without customer beeing in session).

1.2.3.3 Low-value transactions

Issuers may exempt transactions from SCA provided that the following conditions are met:

- the payment amount does not exceed EUR 30,

- the cumulative amount of previous payment transactions without SCA does not exceed EUR 100,

- the number of previous payment transactions without SCA does not exceed five consecutive payment transactions.

Please note that low-vale exemptions must be requested to be considered for a frictionless authentication flow.

1.2.3.4 Transaction risk analysis

Acquirers and issuers are allowed not to apply SCA provided the overall fraud rate is not higher than the reference fraud rate for the exemption threshold value (ETV) specified in the table below and where the risk-based assesment of each individual transaction can be considered as low risk.

| ETV | Card-based payments |

| EUR 500 | 1 bps |

| EUR 250 | 6 bps |

| EUR 100 | 13 bps |

1.2.3.5 One-leg out transactions

One-leg out transactions are such transactions where either the payer’s payment service provider or the payee’s payment service provider are located outside the European Union.

Payment service provider in the context of a card based transaction and in the spirit of the PSD2 are regularily acquirer and issuer.

Thus, neither the nationality of the cardholder nor the merchant’s business location are relevant for the assessment wether a transaction is out of scope due to the ‘one-leg out’ rule.

2. Integration Methods

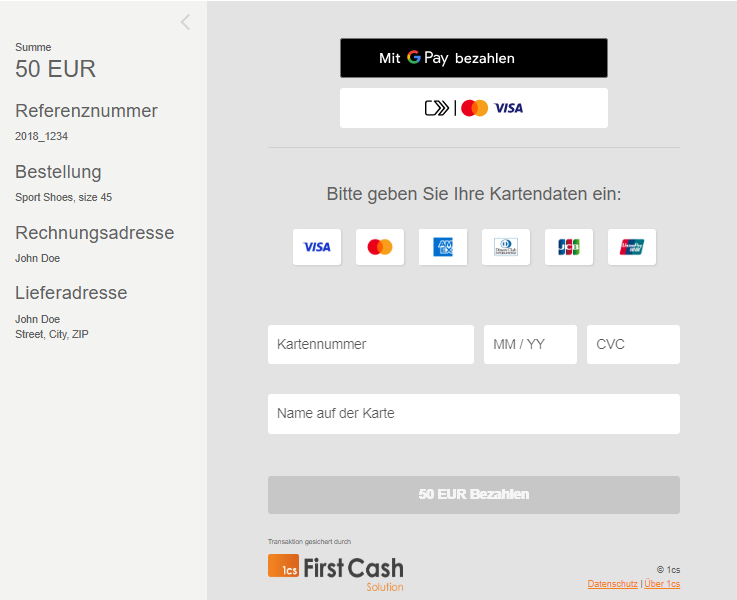

2.1 Card processing – Credit Card Form

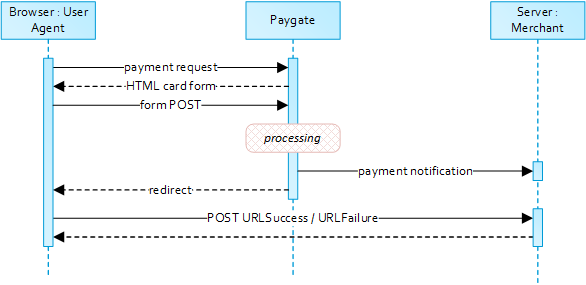

When requesting card payments via First Cash Solution hosted forms the complexity of 3-D Secure is completely removed from the merchant implementation.

From a merchant point of view the sequence itself does not differ between 3DS authenticated and non-authenticated payments though 3DS requires consideration of additional data elements in the request and response.

Notice about Cookie-/Session Handling: Please note that some browsers might block necessary cookies when returning to your shop.

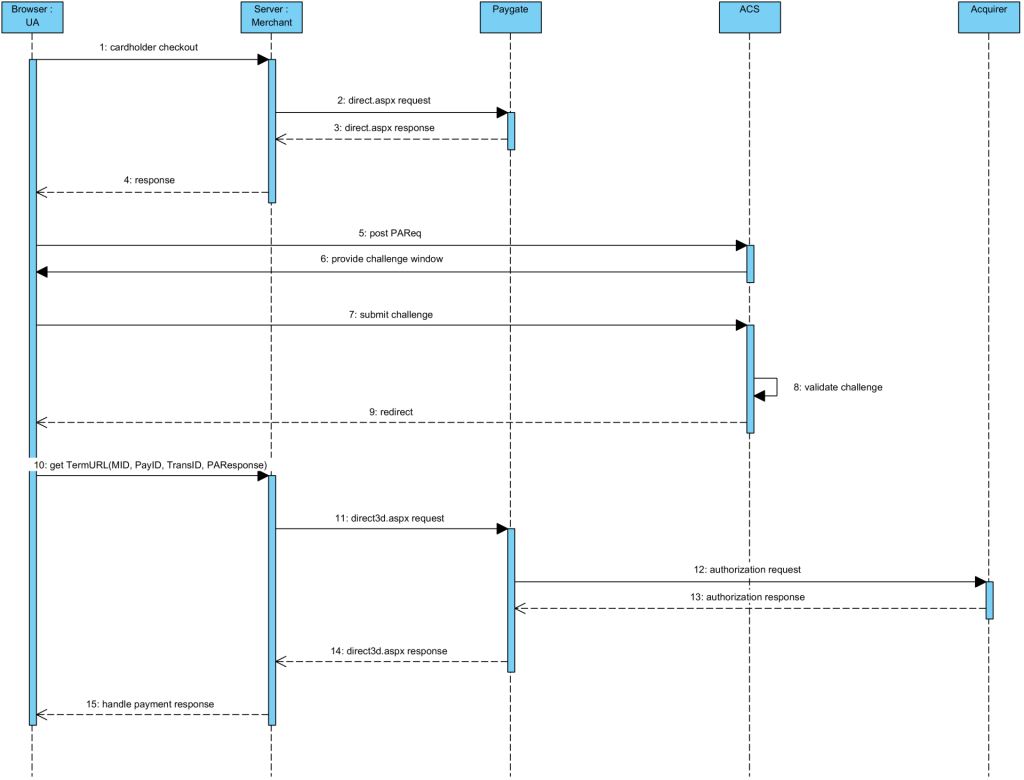

2.1.1 Simplified Sequence Diagram

2.1.2 Payment Request

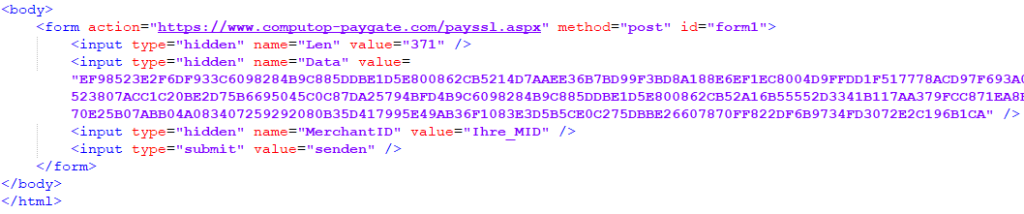

To retrieve a First Cash Solution card form please submit the following data elements via HTTP POST request method to https://www.computop-paygate.com/payssl.aspx.

Notice: For security reasons, 1cs Online Payment System rejects all payment requests with formatting errors. Therefore, please use the correct data type for each parameter.

The following table describes the encrypted payment request parameters:

| Key | Format | Condition | Description |

| MerchantID | ans..30 | M | Merchant identifier assigned by First Cash Solution. Additionally this parameter has to be passed in plain language too. |

| MsgVer | ans..5 | M | Message version. Values accepted · 2.0 · With 3-D Secure 2.x a lot of additional data were required (e.g. browser-information, billing/shipping-address, account-info, …) to improve authentication processing. To handle these information the JSON-objects have been put in place to handle such data. To indicate that these data are used the MsgVer has been implemented. |

| ReqID | ans..32 | O | To avoid double payments or actions (e.g. by ETM), enter an alphanumeric value which identifies your transaction and may be assigned only once. If the transaction or action is submitted again with the same ReqID,1cs Online Payment System will not carry out the payment or new action, but will just return the status of the original transaction or action. Please note that the 1cs Online Payment System must have a finalized transaction status for the first initial action (authentication/authorisation). This does not apply to 3-D Secure authentications that are terminated by a timeout. The 3-D Secure Timeout status does not count as a completed status in which the ReqID functionality on the 1cs Online Payment System does not take effect. Submissions with identical ReqID for an open status will be processed regularly. Notice: Please note that a ReqID is only valid for 12 month, then it gets deleted at the 1cs Online Payment System. |

| TransID | ans..64 | M | Transaction identifier supplied by the merchant. Shall be unique for each payment. |

| RefNr | O | Merchant’s unique reference number, which serves as payout reference in the acquirer EPA file. Please note, without the own shop reference delivery you cannot read out the EPA transaction and regarding the additional Computop settlement file (CTSF) we cannot add the additional payment data. Details on supported format can be found below in payment specific section. Only ASCII characters allowed, special characters (“Umlaute”, diacritics) are not allowed and must be replaced by their ASCII-representation (e.g. ü → ue, é → e, …). | |

| MAC | an64 | M | Hash Message Authentication Code (HMAC) with SHA-256 algorithm. Details can be found here: HMAC Authentication (Request) HMAC Authentication (Notify) |

| Amount | n..10 | M | Amount in the smallest currency unit (e.g. EUR Cent). Please contact the 1cs Online Payment System support, if you want to capture amounts <100 (smallest currency unit). |

| Currency | a3 | M | ISO 4217 three-letter currency code, e.g. EUR, USD, GBP. Please find an overview here: Currency table |

| Capture | ans..6 | O | Determines the type and time of capture. Values accepted: · AUTO = completion immediately after authorisation (default value) · MANUAL = Capturing made by the merchant. Capture is normally initiated at time of delivery. · NUMBER = Delay in hours until the capture (whole number; 1 to 696). |

| PayTypes | ans..256 | O | With this parameter you can override the accepted schemes, i.e. you can decide within this parameter separated by pipe which of the available credit card schemes are displayed. The template must support this function like for example the “Cards_v1”. Example: PayTypes=VISA|MasterCard |

| billingDescriptor | ans..22 | O | A descriptor to be printed on a cardholder’s statement. Please also refer to the additional comments made elswhere for more information about rules and regulations. |

| OrderDesc | ans..768 | O | Order description. |

| AccVerify | a3 | O | Indicator to request an account verification (aka zero value authorization). If an account verification is requested the submitted amount will be optional and ignored for the actual payment transaction (e.g. authorization). Values accepted · Yes |

| threeDSPolicy | JSON | O | Object specifying authentication policies and excemption handling strategies. |

| priorAuthenticationInfo | JSON | O | Prior Transaction Authentication Information contains optional information about a 3DS cardholder authentication that occurred prior to the current transaction. |

| accountInfo | JSON | O | The account information contains optional information about the customer account with the merchant. |

| billToCustomer | JSON | C | The customer that is getting billed for the goods and / or services. Required for EMV 3DS unless market or regional mandate restricts sending this information. |

| shipToCustomer | JSON | C | The customer that the goods and / or services are sent to. Required if different from billToCustomer. |

| billingAddress | JSON | C | Billing address. Required for EMV 3DS (if available) unless market or regional mandate restricts sending this information. |

| shippingAddress | JSON | C | Shipping address. If different from billingAddress, required for EMV 3DS (if available) unless market or regional mandate restricts sending this information. |

| credentialOnFile | JSON | C | Object specifying type and series of transactions using payment account credentials (e.g. account number or payment token) that is stored by a merchant to process future purchases for a customer. Required if applicable. |

| merchantRiskIndicator | JSON | O | The Merchant Risk Indicator contains optional information about the specific purchase by the customer. If no shippingAddress is present it is strongly recommended to populate the shippingAddressIndicator property with an appropriate value such as shipToBillingAddress, digitalGoods or noShipment. |

| subMerchantPF | JSON | O | Object specifying SubMerchant (Payment Facilitator) details. Only supported by SafeCharge |

| URLSuccess | ans..256 | M | Complete URL which calls up 1cs Online payment system if payment has been successful. The URL may be called up only via port 443. This URL may not contain parameters: In order to exchange values between 1cs OPS and shop, please use the parameter UserData. Common notes: We recommend to use parameter “response=encrypt” to get an encrypted response by 1cs Online Payment System However, fraudster may just copy the encrypted DATA-element which are sent to URLFailure and send the DATA to URLSuccess. Therefore ensure to check the “code”-value which indicates success/failure of the action. Only a result of “code=00000000” should be considered successful. |

| URLFailure | ans..256 | M | Complete URL which calls up 1cs Online payment system if payment has been successful. The URL may be called up only via port 443. This URL may not contain parameters: In order to exchange values between 1cs OPS and shop, please use the parameter UserData. Common notes: We recommend to use parameter “response=encrypt” to get an encrypted response by 1cs Online Payment System However, fraudster may just copy the encrypted DATA-element which are sent to URLFailure and send the DATA to URLSuccess/URLFailure. Therefore ensure to check the “code”-value which indicates success/failure of the action. Only a result of “code=00000000” should be considered successful. |

| URLBack | ans..256 | M | Complete URL which 1cs OPS calls in case that Cancel is clicked by the customer. The parameter “URLBack” can be sent either as plain parameter (unencrypted) (compatibility mode) or be part of encrypted payment request parameters (preferred mode) In order to exchange values between 1cs OPS and shop you may use something like this: URLBack=https://your.shop.com/back.php?param1%3Dvalue1%26param2%3Dvalue3%26status%3Dcancelled When user cancels payment this URL is called exactly like this and you may use URL Decode to extract parameter and values. |

| Response | a7 | O | Status response sent by the 1cs OPS to URLSuccess and URLFailure, should be encrypted. For this purpose, transmit Response=encrypt parameter. |

| URLNotify | ans..256 | M | Complete URL which 1cs Online Payment system calls up in order to notify the shop about the payment result. The URL may be called up only via port 443. It may not contain parameters: Use the UserData parameter instead. Common notes: We recommend to use parameter “response=encrypt” to get an encrypted response by 1cs OPS However, fraudster may just copy the encrypted DATA-element which are sent to URLFailure and send the DATA to URLSuccess/URLNotify. Therefore ensure to check the “code”-value which indicates success/failure of the action. Only a result of “code=00000000” should be considered successful. |

| userData | ans..1024 | O | If specified at request, 1cs Online Payment System forwards the parameter with the payment result to the shop. |

| Custom | ans..1024 | O | “Custom”-parameter is added to the request data before encryption and is part of encrypted “Data” in 1cs Online Payment System request. By this they are protected against manipulation by a consumer. The Custom-value is added to the 1cs Online Payment System response in plain text and the “|” is replaced by a “&”. By this you can put a single value into Custom-parameter and get multiple key-value-pairs back in response for your own purpose. Please find a samples here: Custom |

| Plain | ans..50 | O | A single value to be set by the merchant to return some information unencrypted in response/notify, e.g. the MID. “Plain”-parameter is part of encrypted “Data” in 1cs Online Payment System and therefore protected against manipulation. |

| Expiration Time | ans..19 | O | timestamp for the end time of the transaction processing, specified in UTC. Format: YYYY-MM-ddTHH:mm:ss |

The 1cs Online Payment System will return an HTML document in the response body representing the requested card form. The form may be included in the merchant checkout page or used as a standalone page to redirect the cardholder to.

Cardholder authentication and payment authorization will take place once the cardholder entered all required card details and submitted the form data to the 1cs Online Payment System.

Note: In case you are using your own templates (Corporate Payment Page), please make sure you include Cardholder name on your custom template. Cardholder name is mapped to the 1cs Online Payment System API parameter “CreditCardHolder”. Cardholder name field must not contain any special characters and must have minimal length of 2 characters and maximum length of 45 characters.

When the payment is completed the 1cs Online Payment System will send a notification to the merchant server (i.e. URLNotify) and redirect the browser to the URLSuccess resepctively to the URLFailure.

The blowfish encrypted data elements as listed in the following table are transferred via HTTP POST request method to the URLNotify and URLSuccess/URLFailure.

Notice: Please notice that in case of Fallback to 3-D Secure 1.0 the URLSuccess or URLFailure is called with GET. Therefore your systems should be able to receive parameters both via GET and via POST.

The credit card form can be highly customized by using your own template.

2.1.3 HTTP POST to URLSuccess / URLFailure / URLNotify

In case of using REST API you will always receive a link where the merchant has to redirect the consumer to complete the payment.

| REST | Format | CND | Description |

|---|---|---|---|

| “paymentId”: “…” | an32 | M | May be “00000000000000000000000000000000” if not yet set by 1cs OPS |

| “_Links.self.type”: “…” | an..20 | M | “application/json” |

| “_Links.redirect.href”: “…” | an..1024 | M | Merchant needs to redirect consumer to this URL to complete payment |

| “_Links.redirect.type”: “…” | an..20 | M | “text/html” |

Merchant can use inquire.aspx

The following table gives the result parameters which the 1cs Online Payment System transmits to URLSuccess or URLFailure and URLNotify. If you have specified the Response=encrypt parameter, the following parameters are sent Blowfish encrypted to your system:

pls. be prepared to receive additional parameters at any time and do not check the order of parameters

the parameters (e.g. MerchantId, RefNr) should not be checked case-sensitive

| Key | Format | Condition | Description |

| MID | ans..30 | M | Merchant identifier assigned by First Cash Solution. |

| MsgVer | ans..5 | M | Message version. Accepted values: · 2.0 · With 3-D Secure 2.x a lot of additional data were required (e.g. browser-information, billing/shipping-address, account-info, …) to improve authentication processing. To handle these information the JSON-objects have been put in place to handle such data. To indicate that these data are used the MsgVer has been implemented. |

| PayID | ans32 | M | ID assigned by First Cash Solution for the payment, e.g. for referencing in batch files as well as for capture or credit request. |

| XID | ans64 | M | ID for all single transactions (authorisation, capture, credit note) for one payment assigned by 1cs Online Payment System |

| TransID | ans..64 | M | TransactionID provided by you which should be unique for each payment |

| schemeReferenceID | ans..64 | C | Card scheme specific transaction ID required for subsequent credential-on-file payments, delayed authorizations and resubmissions. Mandatory: CredentialOnFile – initial false – unscheduled MIT / recurring schemeReferenceID is returned for 3DS2-payments. In case of fallback to 3DS1 you will also need to check for TransactionId. The schemeReferenceID is a unique identifier generated by the card brands and as a rule First Cash Solution merchants can continue to use the SchemeReferenceIDs for subscription plans that were created while using another PSP environment / 1cs OPS MerchantID / Acquirer ContractID / Acquirer. |

| RefNr. | O | Reference number taken from request | |

| Status | a..20 | M | Staus of the transaction. Values accepted: · Authorized · OK (Sale) · FAILED In case of Authentication-only the Status will be either OK or FAILED. |

| Description | ans..1024 | M | Further details in the event that payment is rejected. Please do not use the Description but the Code parameter for the transaction status analysis! |

| Code | n8 | M | Error code according to the 1cs Online Payment System response code. |

| card | JSON | M | Card data. |

| ipInfo | JSON | O | Object containing IP information. |

| threeDSData | JSON | M | Authentication data. |

| resultsResponse | JSON | C | In case the authentication process included a cardholder challenge additional information about the challenge result will be provided. |

| externalPaymentData | JSON | O | Optional additional data from acquirer/issuer/3rd party for authorization. |

| Plain | ans..50 | O | A single value to be set by the merchant to return some information unencrypted in response/notify, e.g. the MID. “Plain”-parameter is part of encrypted “Data” in 1cs Online Payment System and therefore protected against manipulation. |

| Custom | ans..1024 | O | “Custom”-parameter is added to the request data before encryption and is part of encrypted “Data” in 1cs Online Payment System request. By this they are protected against manipulation by a consumer. The Custom-value is added to the 1cs Online Payment System response in plain text and the “|” is replaced by a “&”. By this you can put a single value into Custom-parameter and get multiple key-value-pairs back in response for your own purpose. |

| userData | ans..1024 | O | If specified at request, the 1cs Online Payment System forwards the parameter with the payment result to the shop. |

| MAC | an64 | M | Hash Message Authentication Code (HMAC) with SHA-256 algorithm. Details can be found here: HMAC Authentication (Request) HMAC Authentication (Notify) |

2.1.4 Credit card payments with separate authorisation

For credit card payments the ORDER can be separated from the subsequent authorisation and the following steps. Therefore initially the SSL credit card payment is initiated via 1cs Online Payment System form or via Server-to-Server-connection like in the chapters above with an additional parameter. Later it is authorised using the interface authorize.aspx via server-to-server connection. For initialising visit the following URL:

https://www.computop-paygate.com/payssl.aspx

For Server-to-Server-connection it is the following URL:

https://www.computop-paygate.com/direct.aspx

The following table describes the encrypted payment request parameters:

| Key | Format | CND | Description |

| TxType | ans..20 | M | Submit “Order” to initialize a payment which later will be authorised via interface authorize.aspx. Please note that in combination with the used 3-D Secure method a separate setting is necessary. Please contact directly the 1cs Online Payment System Helpdesk. |

In order to authorise a previously with TxType=Order initiated SSL credit card payment, please visit the following URL:

https://www.computop-paygate.com/authorize.aspx

Notice: Please note, that for an initial order KPN/CVC/CVV-check is not possible. For the subsequent reservation request this ID also cannot be passed on.

Notice: For security reasons, the 1cs Online Payment System rejects all payment requests with formatting errors. Therefore, please use the correct data type for each parameter.

The following table describes the encrypted payment request parameters:

| Key | Format | CND | Description |

| MerchantID | ans..30 | M | MerchantID, assigned by the 1cs Online Payment System. Additionally this parameter has to be passed in plain language too. |

| PayID | an32 | M | ID assigned by the 1cs Online Payment System for the payment, e.g. for referencing in batch files as well as for capture or credit request. |

| TransID | ans..64 | M | TransactionID provided by you which should be unique for each payment |

| Amount | n..10 | M | Amount in the smallest currency unit (e.g. EUR Cent). Please contact the 1cs Online Payment System Helpdesk, if you want to capture amounts <100 (smallest currency unit). |

| Currency | a3 | M | Currency, three digits DIN / ISO 4217, e.g. EUR, USD, GBP. Please find an overview here: Currency table |

| OrderDesc | ans..768 | O | Description of purchased goods, unit prices etc. |

| MAC | an64 | M | Hash Message Authentication Code (HMAC) with SHA-256 algorithm. Details can be found here: HMAC Authentication (Request) HMAC Authentication (Notify) |

| Capture | an..6 | OM | Determines the type and time of capture. Capture Mode: AUTO: Capturing immediately after authorisatoin (default value) MANUAL: Capturing made by the merchant. Capture is normally initiated at time of delivery. <Number>: Delay in hours until the capture (whole number; 1 to 696). |

The following table describes the result parameters with which the 1cs online payment system responds to your system

pls. be prepared to receive additional parameters at any time and do not check the order of parameters

the parameters (e.g. MerchantId, RefNr) should not be checked case-sensitive

| Key | Format | CND | Description |

| MID | ans..30 | M | MerchantID, assigned by the 1cs Online Payment System |

| PayID | an32 | M | ID assigned by the 1cs Online Payment System for the payment, e.g. for referencing in batch files as well as for capture or credit request. |

| XID | an32 | M | ID for all single transactions (authorisation, capture, credit note) for one payment assigned by 1cs Online Payment System |

| Code | n8 | M | Error code according to 1cs OPS Response Codes (A4 Error codes) |

| Description | ans..1024 | M | Further details in the event that payment is rejected. Please do not use the Description but the Code parameter for the transaction status analysis! |

| TransID | ans..64 | M | TransactionID provided by you which should be unique for each payment |

| Status | a..50 | M | AUTHORIZED or FAILED |

| RefNr | O | Merchant’s unique reference number, which serves as payout reference in the acquirer EPA file. Please note, without the own shop reference delivery you cannot read out the EPA transaction and regarding the additional 1cs OPS settlement file (CTSF) we cannot add the additional payment data. Details on supported format can be found below in payment specific section. Only ASCII characters allowed, special characters (“Umlaute”, diacritics) are not allowed and must be replaced by their ASCII-representation (e.g. ü → ue, é → e, …). |

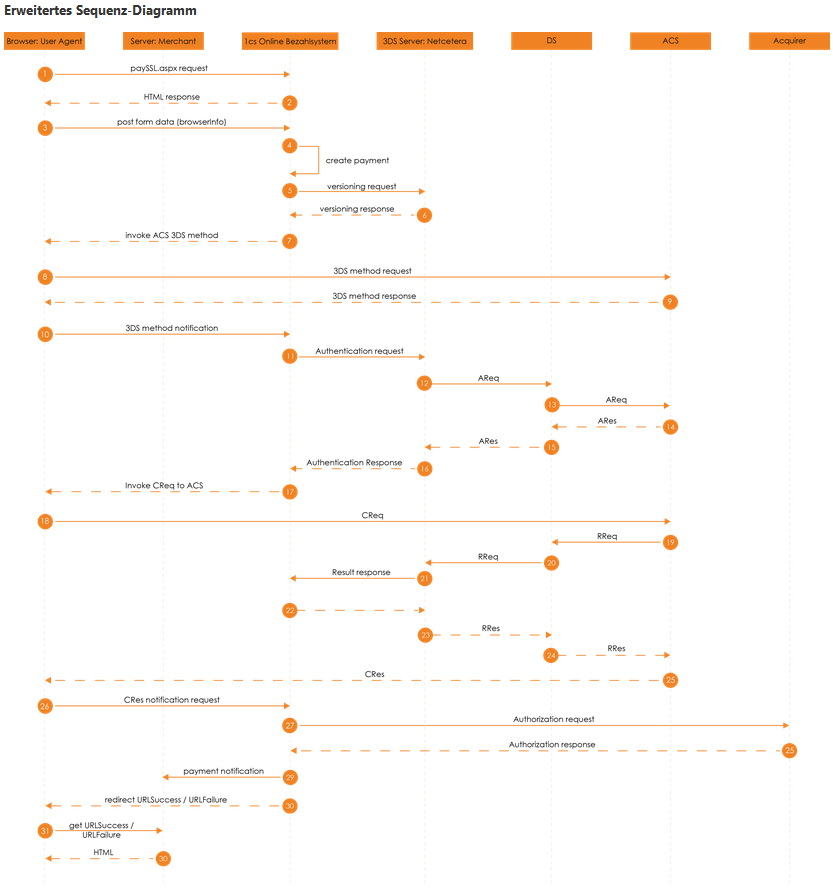

2.1.5 Extended Sequence Diagram

2.2 Server-2-Server Integration

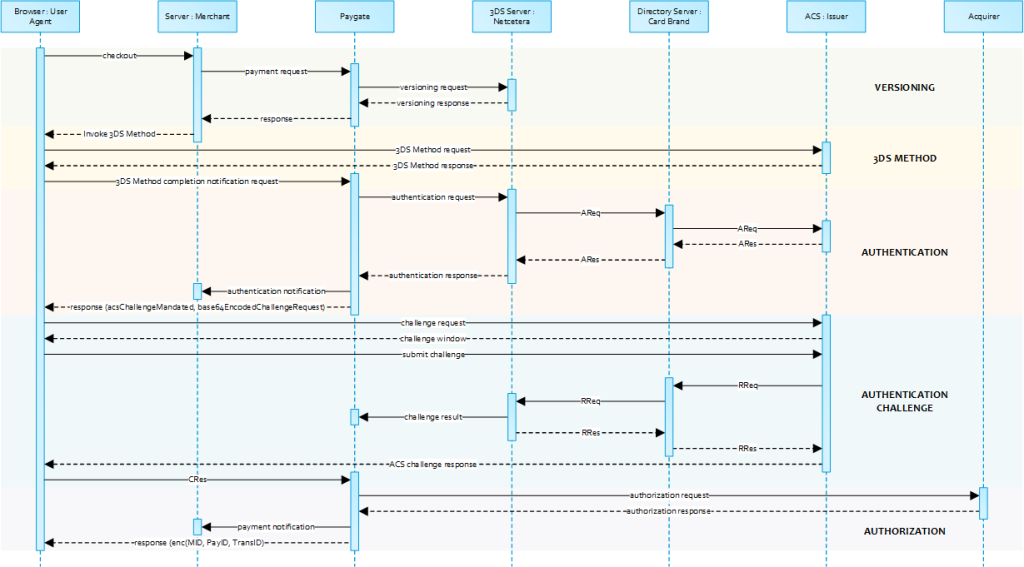

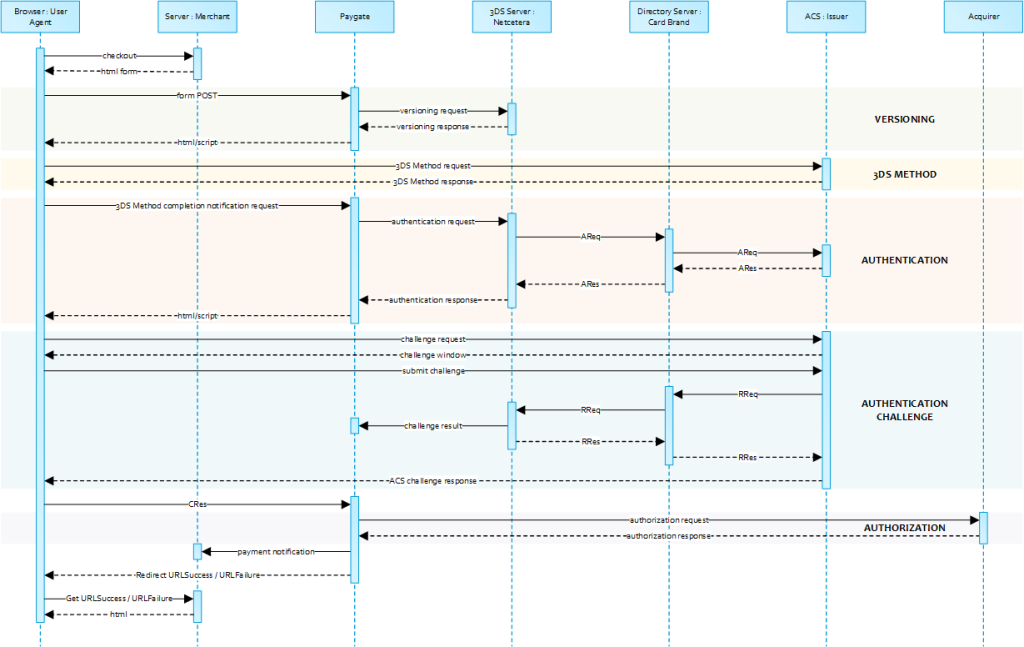

2.2.1 Card processing – Server-2-Server integration

A 3DS 2.0 payment sequence may comprise the following distinct activities:

- Versioning

- Request ACS and DS Protocol Version(s) that correspond to card account range as well as an optional 3DS Method URL

- 3-D Secure Method

- Connect the cardholder browser to the issuer ACS to obtain additional browser data

- Authentication

- Submit authentication request to the issuer ACS

- Challenge

- Challenge the carholder if mandated

- Authorization

- Authorize the authenticated transaction with the acquirer

2.2.2 Server-2-Server Diagram

Notice: Please note that the communication between client and Access Control Server (ACS) is implemented through iframes. Thus, responses arrive in an HTML subdocument and you may establish correspondent event listeners in your root document.

Alternatively you could solely rely on asynchronous notifications delivered to your backend. In those cases you may have to consider methods such as long polling, SSE or websockets to update the client.

2.2.3 Payment Initiation

The initial request to the 1cs Online Payment System will be the same regardless of the underlying 3-D Secure Protocol.

In order to start a server-to-server 3-D Secure card payment sequence please post the following key-value-pairs to https://www.computop-paygate.com/direct.aspx.

2.2.4 Call of interface: general parameters

Notice: For credit card payments with 3-D Secure, please note the different cases as explained separately in the chapter at the start of the handbook. If the credit card is registered for Verified or SecureCode or SafeKey, the next phase is divided into two steps of authentication and payment. However it always begins in the same way via the direct.aspx interface. The first response however is the receipt of Javascript code or other parameters in order to carry out a second call up of the direct3d.aspx interface. Only after that, do you receive the listed parameter as a response.

To carry out a credit card payment via a Server-to-Server connection, please use the following URL:

https://www.computop-paygate.com/direct.aspx

Request Elements

Notice: For security reasons, the 1cs Online Payment System rejects all payment requests with formatting errors. Therefore, please use the correct data type for each parameter.

The following table describes the encrypted payment request parameters:

Notice: In case of a merchant initiated recurring transaction the JSON objects (besides credentialOnFile and card), the URLNotify and TermURL are not mandatory parameters, because no 3-D Secure and no risk evaluation is done by the card issuing bank and the payment result is directly returned within the response.

| Key | Format | Condition | Description |

| MerchantID | ans..30 | M | Merchant identifier assigned by First Cash Solution. Additionally this parameter has to be passed in plain language too. |

| MsgVer | ans..5 | M | 1cs Online Payment System Message version. Valid values: Values accepted: · Value: 2.0 · Description: With 3-D Secure 2.x a lot of additional data were required (e.g. browser-information, billing/shipping-address, account-info, …) to improve authentication processing. To handle these information the JSON-objects have been put in place to handle such data. To indicate that these data are used the MsgVer has been implemented. |

| TransID | ans..64 | M | TransactionID provided by you which should be unique for each payment |

| ReqID | ans..32 | O | To avoid double payments or actions (e.g. by ETM), enter an alphanumeric value which identifies your transaction and may be assigned only once. If the transaction or action is submitted again with the same ReqID, 1cs Online Payment System will not carry out the payment or new action, but will just return the status of the original transaction or action. Please note that the 1cs Online Payment System must have a finalized transaction status for the first initial action (authentication/authorisation). This does not apply to 3-D Secure authentications that are terminated by a timeout. The 3-D Secure Timeout status does not count as a completed status in which the ReqID functionality on 1cs Online Payment System does not take effect. Submissions with identical ReqID for an open status will be processed regularly. Notice: Please note that a ReqID is only valid for 12 month, then it gets deleted at the 1cs Online Payment System. |

| RefNr | O | Merchant’s unique reference number, which serves as payout reference in the acquirer EPA file. Please note, without the own shop reference delivery you cannot read out the EPA transaction and regarding the additional 1cs Online Payment System settlement file (CTSF) we cannot add the additional payment data. Details on supported format can be found below in payment specific section. Only ASCII characters allowed, special characters (“Umlaute”, diacritics) are not allowed and must be replaced by their ASCII-representation (e.g. ü → ue, é → e, …). | |

| schemeReferenceID | ans..64 | C | Card scheme specific transaction ID required for subsequent credential-on-file payments, delayed authorizations and resubmissions. Mandatory: CredentialOnFile – initial false – unscheduled MIT / recurring schemeReferenceID is returned for 3DS2-payments. In case of fallback to 3DS1 you will also need to check for TransactionId. The schemeReferenceID is a unique identifier generated by the card brands and as a rule 1cs OPS merchants can continue to use the SchemeReferenceIDs for subscription plans that were created while using another PSP environment / 1cs OPS MerchantID / Acquirer ContractID / Acquirer. |

| industrySpecificTxType | ans..20 | C | This parameter is required whenever an industry specific transaction is processed according to the card brands MIT (Merchant Initiated Transactions) Framework. Only supported with Omnipay and GICC. Supported with CB2A for Reauthorization, only. Values accepted: – Resubmission: A merchant performs a re-submission in cases where it requested an authorization, but received a decline due to insufficient funds; however, the goods or services were already delivered to the cardholder. Merchants in such scenarios can resubmit the request to recover outstanding debt from cardholders. – Reauthorization: A merchant initiates a re-authorization when the completion or fulfillment of the original order or service extends beyond the authorization validity limit set by Visa. There are two common re-authorization scenarios: • Split or delayed shipments at eCommerce retailers. A split shipment occurs when not all the goods ordered are available for shipment at the time of purchase. If the fulfillment of the goods takes place after the authorization validity limit set by Visa, eCommerce merchants perform a separate authorization to ensure that consumer funds are available. • Extended stay hotels, car rentals, and cruise lines. A re-authorization is used for stays, voyages, and/or rentals that extend beyond the authorization validity period set by Visa. – DelayedCharges: Delayed charges are performed to process a supplemental account charge after original services have been rendered and respective payment has been processed. – NoShow: Cardholders can use their Visa cards to make a guaranteed reservation with certain merchant segments. A guaranteed reservation ensures that the reservation will be honored and allows a merchant to perform a No Show transaction to charge the cardholder a penalty according to the merchant’s cancellation policy. Note: For merchants that accept token-based payment credentials to guarantee a reservation, it is necessary to perform a CIT (Account Verification Service) at the time of reservation to be able perform a No Show transaction later. Note: It is always submitted in conjunction with the “schemeReferenceID” parameter. Please contact support@1cs.de for the supported Acquirer and card brands. |

| Amount | n..10 | M | Amount in the smallest currency unit (e.g. EUR Cent). Please contact then support@1cs.de, if you want to capture amounts <100 (smallest currency unit). |

| Currency | a3 | M | Currency, three digits DIN / ISO 4217, e.g. EUR, USD, GBP. Please find an overview here: A1 Currency table EN |

| card | JSON | M | Card data. |

| Capture | ans..6 | OM | Determines the type and time of capture. Values accepted: · AUTO = Capturing immediately after authorisation (default value). · MANUAL = Capturing made by the merchant. Capture is normally initiated at time of delivery. · <NUMBER> = Delay in hours until the capture (whole number; 1 to 696). |

| billingDescriptor | ans..22 | O | A descriptor to be printed on a cardholder’s statement. Please also refer to the additional comments made elswhere for more information about rules and regulations. |

| OrderDesc | ans..768 | O | Order description. |

| AccVerify | a3 | O | Indicator to request an account verification (aka zero value authorization). If an account verification is requested the submitted amount will be optional and ignored for the actual payment transaction (e.g. authorization). Values accepted: · Yes |

| threeDSPolicy | JSON | O | Object specifying authentication policies and excemption handling strategies. |

| threeDSData | JSON | C | Object detailing authentication data in case authentication was performed through a third party or by the merchant. |

| priorAuthenticationInfo | JSON | O | Prior Transaction Authentication Information contains optional information about a 3DS cardholder authentication that occurred prior to the current transaction. |

| browserInfo | JSON | C | Accurate browser information are needed to deliver an optimized user experience. Required for 3-D Secure 2.0 transactions. |

| accountInfo | JSON | O | The account information contains optional information about the customer account with the merchant. Optional for 3-D Secure 2.0 transactions. |

| billToCustomer | JSON | C | The customer that is getting billed for the goods and / or services. Required unless market or regional mandate restricts sending this information. |

| shipToCustomer | JSON | C | The customer that the goods and / or services are sent to. Required (if available and different from billToCustomer) unless market or regional mandate restricts sending this information. |

| billingAddress | JSON | C | Billing address. Required for 3-D Secure 2.0 (if available) unless market or regional mandate restricts sending this information. |

| shippingAddress | JSON | C | Shipping address. If different from billingAddress, required for 3-D Secure 2.0 (if available) unless market or regional mandate restricts sending this information. |

| credentialOnFile | JSON | C | Object specifying type and series of transactions using payment account credentials (e.g. account number or payment token) that is stored by a merchant to process future purchases for a customer. Required if applicable. |

| merchantRiskIndicator | JSON | O | The Merchant Risk Indicator contains optional information about the specific purchase by the customer. |

| subMerchantPF | JSON | O | Object specifying SubMerchant (Payment Facilitator) details Only supported by SafeCharge |

| TermURL | ans..256 | C | Only for 3-D Secure: URL of the shop which has been selected by the Access Control Server (ACS) of the bank to transmit the result of the authentication. The bank transmits the parameters PayID, TransID and MerchantID via GET and the PAResponse parameter via POST to the TermURL. In case of a merchant initiated recurring transaction the JSON objects (besides credentialOnFile and card), the URLNotify and TermURL are not mandatory parameters, because no 3-D Secure and no risk evaluation is done by the card issuing bank and the payment result is directly returned within the response. |

| URLNotify | an..256 | C | Complete URL which the 1cs Online Payment System calls up in order to notify the shop about the payment result. The URL may be called up only via port 443. It may not contain parameters: Use the UserData parameter instead. In case of a merchant initiated recurring transaction the JSON objects (besides credentialOnFile and card), the URLNotify and TermURL are not mandatory parameters, because no 3-D Secure and no risk evaluation is done by the card issuing bank and the payment result is directly returned within the response. Common notes: We recommend to use parameter “response=encrypt” to get an encrypted response by 1cs OPS However, fraudster may just copy the encrypted DATA-element which are sent to URLFailure and send the DATA to URLSuccess/URLNotify. Therefore ensure to check the “code”-value which indicates success/failure of the action. Only a result of “code=00000000” should be considered successful. |

| userData | ans..1024 | O | If specified at request, the 1cs Online Payment System forwards the parameter with the payment result to the shop. |

| MAC | an64 | M | Hash Message Authentication Code (HMAC) with SHA-256 algorithm. Details can be found here: HMAC Authentication (Request) HMAC Authentication (Notify) |

Please note the additional parameter for a specific credit card integration in the section “Specific parameters”

Response Elements (authentication)

The following table describes the result parameters with which the 1cs online payment system responds to your system

Notice: be prepared to receive additional parameters at any time and do not check the order of parameters

Notice: the parameters (e.g. MerchantId, RefNr) should not be checked case-sensitive

| Key | Format | Condition | Description |

| MID | ans..30 | M | Merchant identifier assigned by First Cash Solution. |

| PayID | ans32 | M | ID assigned by 1cs Online Payment System for the payment, e.g. for referencing in batch files as well as for capture or credit request. |

| XID | ans32 | M | ID for all single transactions (authorisation, capture, credit note) for one payment assigned by 1cs Online Payment. |

| TransID | ans..64 | M | TransactionID provided by you which should be unique for each payment. |

| RefNr | O | Reference number as given in request | |

| Code | n8 | M | The 1cs Online Payment System response code. |

| Status | a..20 | M | Status of the transaction. Values accepted: · AUTHENTICATION_REQUEST · PENDING · FAILED |

| Description | ans..1024 | M | Further details in the event that payment is rejected. Please do not use the Description but the Code parameter for the transaction status analysis! |

| versioningData | JSON | M | The Card Range Data data element contains information that indicates the most recent EMV 3-D Secure version supported by the ACS that hosts that card range. It also may optionally contain the ACS URL for the 3DS Method if supported by the ACS and the DS Start and End Protocol Versions which support the card range. |

| threeDSLegacy | JSON | C | Object containing the data elements required to construct the Payer Authentication request in case of a fallback to 3-D Secure 1.0. |

| UserData | ans..1024 | C | If specified at request, the 1cs Online Payment System forwards the parameter with the payment result to the shop. |

| Card | JSON | M | Card data |

versioningData

The versioningData object will indicate the EMV 3-D Secure protocol versions (i.e. 2.1.0 or higher) that are supported by Access Control Server of the issuer.

If the corresponding protocol version fields are NULL it means that the BIN range of card issuer is not registered for 3-D Secure 2.0 and a fallback to 3-D Secure 1.0 is required for transactions that are within the scope of PSD2 SCA.

When parsing versioningData please also refer to the subelement errorDetails which will specify the reason if some fields are not pupoluated (e.g. Invalid cardholder account number passed, not available card range data, failure in encoding/serialization of the 3-D Secure Method data etc).

BASEURL= https://www.computop-paygate.com/

{

"threeDSServerTransID": "14dd844c-b0fc-4dfe-8635-366fbf43468c",

"acsStartProtocolVersion": "2.1.0",

"acsEndProtocolVersion": "2.1.0",

"dsStartProtocolVersion": "2.1.0", "dsEndProtocolVersion": "2.1.0", "threeDSMethodURL": "http://www.acs.com/script", "threeDSMethodDataForm": "eyJ0aHJlZURTTWV0aG9kTm90aWZpY2F0aW9uVVJMIjoiaHR0cHM6Ly93d3cuY29tcHV0b3AtcG

F5Z2F0ZS5jb20vY2JUaHJlZURTLmFzcHg_YWN0aW9uPW10aGROdGZuIiwidGhyZWVEU1Nlcn

ZlclRyYW5zSUQiOiIxNGRkODQ0Yy1iMGZjLTRkZmUtODYzNS0zNjZmYmY0MzQ2 OGMifQ==", "threeDSMethodData": { "threeDSMethodNotificationURL": "https://www.computop-paygate.com/cbThreeDS.aspx?action=mthdNtfn", "threeDSServerTransID": "14dd844c-b0fc-4dfe-8635-366fbf43468c" } }

2.2.5 3-D Secure Method

The 3-D Secure Method allows for additional browser information to be gathered by an ACS prior to receipt of the authentication request message (AReq) to help facilitate the transaction risk assessment. Support of 3DS Method is optional and at the discretion of the issuer.

The versioningData object contains a value for threeDSMethodURL. The merchant is supposed to invoke the 3DS Method via a hidden HTML iframe in the cardholder browser and send a form with a field named threeDSMethodData via HTTP POST to the ACS 3-D Secure Method URL.

3-D Secure Method: threeDSMethodURL

Please not that the threeDSMethodURL will be populated by the 1cs Online Payment System if the issuer does not support the 3DS Method. The 3DS Method Form Post as outlined below must be performed independently from whether it is supported by the issuer. This is necessary to facilitate direct communication between the browser and the 1cs Online Payment System in case of a mandated challenge or a frictionless flow.

3-D Secure Method: No issuer threeDSMethodURL

3-D Secure Method Form Post

<form name="frm" method="POST" action="Rendering URL">

<input type="hidden" name="threeDSMethodData" value="eyJ0aHJlZURTU2VydmVyVHJhbnNJRCI6IjNhYzdjYWE3LWFhNDItMjY2My03OTFiLTJhYzA1YTU0MmM0YSIsI

nRocmVlRFNNZXRob2ROb3RpZmljYXRpb25VUkwiOiJ0aHJlZURTTWV0aG9kTm90aWZpY2F0aW9uVVJMIn0">

</form>

The ACS will intercat with the Cardholder browser via the HTML iframe and then store the applicable values with the 3-D Secure Server Transaction ID for use when the subsequent authentication message is received containing the same 3-D Secure Server Transaction ID.

Netcetera 3DS Web SDK: You may use the operations init3DSMethod or createIframeAndInit3DSMethod at your discreation from the nca3DSWebSDKin order to iniatiate the 3-D Secure Method. Please refer to the Integration Manual at https://mpi.netcetera.com/3dsserver/doc/current/integration.html#Web_Service_API.

Once the 3-D Secure Method is concluded the ACS will instruct the cardholder browser through the iFrame response document to submit threeDSMethodData as a hidden form field to the 3-D Secure Method Notification URL.

Once the 3DS Method is concluded the ACS will instruct the cardholder browser through the iFrame response document to submit threeDSMethodData as a hidden form field to the 3DS Method Notification URL.

ACS response document

<!DOCTYPE html>

<html lang="en"> <head> <meta charset="UTF-8"/> <title>Identifying...</title> </head> <body> <script> var tdsMethodNotificationValue = 'eyJ0aHJlZURTU2VydmVyVHJhbnNJRCI6ImUxYzFlYmViLTc0ZTgtNDNiMi1iMzg1LTJlNjdkMWFhY2ZhMiJ9'; var form = document.createElement("form"); form.setAttribute("method", "post"); form.setAttribute("action", "notification URL"); addParameter(form, "threeDSMethodData", tdsMethodNotificationValue); document.body.appendChild(form); form.submit(); function addParameter(form, key, value) { var hiddenField = document.createElement("input"); hiddenField.setAttribute("type", "hidden"); hiddenField.setAttribute("name", key); hiddenField.setAttribute("value", value); form.appendChild(hiddenField); } </script> </body> </html>

3-D Secure Method notification form

<form name="frm" method="POST" action="3DS Method Notification URL">

<input type="hidden" name="threeDSMethodData" value="eyJ0aHJlZURTU2VydmVyVHJhbnNJRCI6ImUxYzFlYmViLTc0ZTgtNDNiMi1iMzg1LTJlNjdkMWFhY2ZhMiJ9"> </form>

Notice: Please note that the threeDSMethodNotificationURL as embedded in the Base64 encoded threeDSMethodData value points to the 1cs Online Payment System and must not be modified. The merchant notification is delivered to the URLNotify as provided in the original request or as configured for the MerchantID in the 1cs Online Payment System.

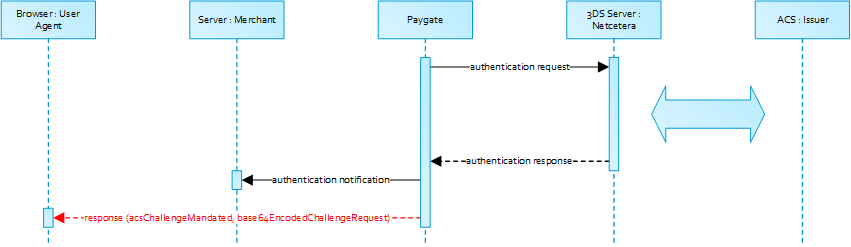

2.2.6 Authentication

If 3-D Secure Method is supported by the issuer ACS and was invoked by the merchant, the 1cs Online Payment System will automatically continue with the authentication request once the 3-D Secure Method has completed (i.e. 3DS Method Notification).

The authentication result will be transferred via HTTP POST to the URLNotify. It may indicate that the Cardholder has been authenticated, or that further cardholder interaction (i.e. challenge) is required to complete the authentication.

In case a cardholder challenge is mandated the 1cs Online Payment System will transfer a JSON object within the body of HTTP browser response with the elements acsChallengeMandated, challengeRequest, base64EncodedChallengeRequest and acsURL. Otherwise, in a frictionless flow, the 1cs Online Payment System will automatically continue and respond to the cardholder browser once the authorization completed.

Cardholder Challenge: Browser Response

Browser Challenge Response

Data Elements

| Key | Format | Condition | Description |

| acsChallengeMandated | boolean | M | Indication of whether a challenge is required for the transaction to be authorised due to local/regional mandates or other variable: true → Challenge is mandated by local/regional regulations false → Challenge is not mandated by local/regional regulations, but is deemed necessary by the ACS |

| challengeRequest | object | M | Challenge request object. |

| base64EncodedChallengeRequest | string | M | Base64-encoded Challenge Request object. |

| acsURL | string | M | Fully qualified URL of the ACS to be used to post the Challenge Request. |

Schema: Browser challenge response

{

"$schema": "http://json-schema.org/draft-07/schema#",

"type": "object",

"properties": {

"acsChallengeMandated": {"type": "boolean"},

"challengeRequest": {"type": "object"},

"base64EncodedChallengeRequest": {"type": "string"},

"acsURL": {"type": "string"}

},

"required": ["acsChallengeMandated", "challengeRequest", "base64EncodedChallengeRequest", "acsURL"],

"additionalProperties": false

}

Sample: Browser Challenge Response

{

"acsChallengeMandated": true,

"challengeRequest": {

"threeDSServerTransID": "8a880dc0-d2d2-4067-bcb1-b08d1690b26e",

"acsTransID": "d7c1ee99-9478-44a6-b1f2-391e29c6b340",

"messageType": "CReq",

"messageVersion": "2.1.0",

"challengeWindowSize": "01",

"messageExtension": [

{

"name": "emvcomsgextInChallenge",

"id": "tc8Qtm465Ln1FX0nZprA",

"criticalityIndicator": false,

"data": "messageExtensionDataInChallenge"

}

]

},

"base64EncodedChallengeRequest": "base64-encoded-challenge-request",

"acsURL": "acsURL-to-post-challenge-request"

}

Authentication Notification

The data elements of the authentication notification are listed in the table below:

| Key | Format | Condition | Description |

| MID | ans..30 | M | Merchant identifier assigned by First Cash Solution. |

| PayID | an32 | M | ID assigned by the 1cs Online Payment System for the payment, e.g. for referencing in batch files as well as for capture or credit request. |

| TransID | ans..64 | M | TransactionID provided by you which should be unique for each payment |

| Code | n8 | M | The 1cs Online Payment System response code. |

| MAC | an64 | M | Hash Message Authentication Code (HMAC) with SHA-256 algorithm. Details can be found here: HMAC Authentication (Request) HMAC Authentication (Notify) |

| authenticationResponse | JSON | M | Response object in return of the authentication request with the ACS |

Browser Challenge

If a challenge is mandated (see acsChallengeMandated) the browser challenge will occur within the cardholder browser. To create a challenge it is required to post the value base64EncodedChallengeRequest via an HTML iframe to the ACS URL.

Challenge Request

<form name="challengeRequestForm" method="post" action="acsChallengeURL">

<input type="hidden" name="creq" value="ewogICAgInRocmVlRFNTZXJ2ZXJUcmFuc0lEIjogIjhhODgwZGMwLWQyZDItNDA2Ny1iY2IxLWIwOGQxNjkwYj

I2ZSIsCiAgICAiYWNzVHJhbnNJRCI6ICJkN2MxZWU5OS05NDc4LTQ0YTYtYjFmMi0zOTFlMjljNmIzNDAiLAogICAgIm1

lc3NhZ2VUeXBlIjogIkNSZXEiLAogICAgIm1lc3NhZ2VWZXJzaW9uIjogIjIuMS4wIiwKICAgICJjaGFsbGVuZ2VXaW5k

b3dTaXplIjogIjAxIiwKICAgICJtZXNzYWdlRXh0ZW5zaW9uIjogWwoJCXsKCQkJIm5hbWUiOiAiZW12Y29tc2dleHRJb

kNoYWxsZW5nZSIsCgkJCSJpZCI6ICJ0YzhRdG00NjVMbjFGWDBuWnByQSIsCgkJCSJjcml0aWNhbGl0eUluZGljYXRvci

I6IGZhbHNlLAoJCQkiZGF0YSI6ICJtZXNzYWdlRXh0ZW5zaW9uRGF0YUluQ2hhbGxlbmdlIgoJCX0KICAgIF0KfQ==">

</form>

You may use the operations init3DSChallengeRequest or createIFrameAndInit3DSChallengeRequest from the nca3DSWebSDK in order submit the challenge message through the cardholder browser.

Init 3-D Secure Challenge Request – Example

<!DOCTYPE html> <html lang="en"> <head> <meta charset="UTF-8"> <script src="nca-3ds-web-sdk.js" type="text/javascript"></script> <title>Init 3DS Challenge Request - Example</title> </head> <body> <!-- This example will show how to initiate Challenge Reqeuests for different window sizes. --> <div id="frameContainer01"></div> <div id="frameContainer02"></div> <div id="frameContainer03"></div> <div id="frameContainer04"></div> <div id="frameContainer05"></div> <iframe id="iframeContainerFull" name="iframeContainerFull" width="100%" height="100%"></iframe> <script type="text/javascript"> // Load all containers iFrameContainerFull = document.getElementById('iframeContainerFull'); container01 = document.getElementById('frameContainer01'); container02 = document.getElementById('frameContainer02'); container03 = document.getElementById('frameContainer03'); container04 = document.getElementById('frameContainer04'); container05 = document.getElementById('frameContainer05'); // nca3DSWebSDK.init3DSChallengeRequest(acsUrl, creqData, container); nca3DSWebSDK.init3DSChallengeRequest('http://example.com', 'base64-encoded-challenge-request', iFrameContainerFull); // nca3DSWebSDK.createIFrameAndInit3DSChallengeRequest(acsUrl, creqData, challengeWindowSize, frameName, rootContainer, callbackWhenLoaded); nca3DSWebSDK.createIFrameAndInit3DSChallengeRequest('http://example.com', 'base64-encoded-challenge-request', '01', 'threeDSCReq01', container01); nca3DSWebSDK.createIFrameAndInit3DSChallengeRequest('http://example.com', 'base64-encoded-challenge-request', '02', 'threeDSCReq02', container02); nca3DSWebSDK.createIFrameAndInit3DSChallengeRequest('http://example.com', 'base64-encoded-challenge-request', '03', 'threeDSCReq03', container03); nca3DSWebSDK.createIFrameAndInit3DSChallengeRequest('http://example.com', 'base64-encoded-challenge-request', '04', 'threeDSCReq04', container04); nca3DSWebSDK.createIFrameAndInit3DSChallengeRequest('http://example.com', 'base64-encoded-challenge-request', '05', 'threeDSCReq05', container05, () => { console.log('Iframe loaded, form created and submitted'); }); </script> </body> </html>

Once the cardholder challenge is completed, was cancelled or timed out the ACS will instruct the browser to post the results to the notfication URL as specified in the challenge request and to send a Result Request (RReq) via the Directory Server to the 3-D Secure Server.

Notice: Please note that the notification URL submited in the challenge request points to the 1cs Online Payment System and must not be changed.

2.2.7 Authorization

After succefull cardholder authentication or proof of attempted authentication/verification is provided the 1cs Online Payment System will automatically continue with the payment authorization.

In case the cardholder authentication was not succesfull or proof proof of attempted authentication/verification cannot be provided the 1cs Online Payment System will not continue with an authorization request.

In both cases the 1cs Online Payment System will deliver a final notification to the merchant specified URLNotify with the data elements as listed in the table below.

Payment Notification

| Key | Format | Condition | Description |

| MID | ans..30 | M | Merchant identifier assigned by First Cash Solution. |

| MsgVer | ans..5 | M | 1cs Online Payment System Message version. Valid values: 2.0: With 3-D Secure 2.x a lot of additional data were required (e.g. browser-information, billing/shipping-address, account-info, …) to improve authentication processing. To handle these information the JSON-objects have been put in place to handle such data. To indicate that these data are used the MsgVer has been implemented. |

| PayID | ans32 | M | ID assigned by the 1cs Online Payment System for the payment, e.g. for referencing in batch files as well as for capture or credit request. |

| XID | an32 | M | ID for all single transactions (authorisation, capture, credit note) for one payment assigned by the 1cs Online Payment System |

| TransID | ans..64 | M | TransactionID provided by you which should be unique for each payment |

| schemeReferenceID | ans..64 | C | Card scheme specific transaction ID required for subsequent credential-on-file payments, delayed authorizations and resubmssions. Mandatory: CredentialOnFile – initial false – unscheduled MIT / recurring schemeReferenceID is returned for 3DS2-payments. In case of fallback to 3DS1 you will also need to check for TransactionId. The schemeReferenceID is a unique identifier generated by the card brands and as a rule Computop merchants can continue to use the SchemeReferenceIDs for subscription plans that were created while using another PSP environment / 1cs OPS MerchantID / Acquirer ContractID / Acquirer. |

| TrxTime | an21 | M | Transaction time stamp in format DD.MM.YYYY HH:mm:ssff. |

| Status | a..20 | M | Status of the transaction. Values accepted: · Authorized · OK (Sale) · PENDING · FAILED In case of Authentication-only the Status will be either OK or FAILED. |

| Description | ans..1024 | M | Further details in the event that payment is rejected. Please do not use the Description but the Code parameter for the transaction status analysis! |

| Code | n8 | M | the 1cs Online Payment System response code. |

| MAC | an64 | M | Hash Message Authentication Code (HMAC) with SHA-256 algorithm. Details can be found here: HMAC Authentication (Request) HMAC Authentication (Notify) |

| card | JSON | M | Card data. |

| ipInfo | JSON | O | Object containing IP information. |

| threeDSData | JSON | M | Authentication data. |

| resultsResponse | JSON | C | In case the authentication process included a cardholder challenge additional information about the challenge result will be provided. |

| externalPaymentData | JSON | O | Optional additional data from acquirer/issuer/3rd party for authorization. |

| PCNr | n16 | O | Pseudo Card Number: Random number generated by the 1cs Online Payment System which represents a genuine credit card number. The pseudo card number (PCN) starts with 0 and the last 3 digits correspond to those of the real card number. The PCN can be used like a genuine card number for authorisation, capture and credits. PCNr is a response value from the 1cs OPS and is sent as CCNr in Request or part of card-JSON PCNr is a response value from the 1cs OPS and is sent as CCNr in Request or part of card-JSON |

Browser Payment Response

Additionally the JSON formated data elements as listed below are trasferred in the HTTP response body to the cardholder browser. Please note that the data elements (i.e. MID, Len, Data) are base64 encoded.

Data Elements

| Key | Format | Condition | Description |

| MID | string | M | Merchant identifier assigned by First Cash Solution. |

| Len | integer | M | Length of the unencrypted Data string. |

| Data | string | M | Blowfish encrypted string containg a JSON object with MID, PayID and TransID. |

{ "$schema": "http://json-schema.org/draft-07/schema#", "type": "object", "properties": { "MID": { "type": "string" }, "Len": { "type": "integer" }, "Data": { "type": "string" } }, "required": ["MID", "Len", "Data"], "additionalProperties": false }

Merchants are supposed to forward these data elements to their server for decryption and mapping agianst the payment notification. Based on the payment results the merchant server may deliver an appropriate response to the cardholder browser (e.g. success page).

Decrypted Data

| Key | Format | Condition | Description |

| MID | ans..30 | M | Merchant identifier assigned by First Cash Solution. |

| PayID | ans32 | M | ID assigned by the 1cs Online Payment System for the payment, e.g. for referencing in batch files as well as for capture or credit request. |

| TransID | ans..64 | M | TransactionID provided by you which should be unique for each payment |

Sample of the decrypted data:

MID=YourMID&PayID=PayIDassignedby1csOPS&TransID=YourTransID

2.3 3DS 1.0 Fallback

In case the Access Control Server (ACS) of the cardholder’s bank does not support any EMV 3DS protocol version (i.e. 2.0 or higher, see acsStartProtocolVersion) the threeDSMethodDataForm element of the versioningData object in the payment response will be Null.

Sequence Diagram

2.3.1 3DS 1.0 Authentication

In order to a 3DS 1.0 authentication request through the cardholder browser it is required to construct a form with the data elements provided in threeDSLegacy and to post it to the acsURL.

The form fields that are sent to the ACS are listed in the table below:

| Form Element | Description |

| PAReq | A constructed, Base64 encoded and compressed field carrying the Payer Authentication Request Message Fields. The compression algorithm used is a combination of LZ77 and Huffman coding as specified in RFC 1951. |

| TermURL | The merchant URL the ACS will redirect the cardholder to after the authentication has concluded. Note that the 1cs Online Payment System adds the fields PayID, TransID and MID in the query string to the base URL. Please do not alter the TermURL! |

| MD | The MD (i.e. Merchant Data) field can carry whatever data the merchant needs to continue the session. Please note that this field must be present in the form even though it is not used. |

Sample: PAReq form passed through the Cardholder to the ACS URL

<html>

<head>

<script language=\"javascript\">

<!--

function sendpareq()

{

document.pareq_form.submit(); } // --> </script> </head> <body onload="javascript:sendpareq();"> <form action="https://pit.3dsecure.net/VbVTestSuiteService/pit1/acsService/paReq?summary=ZTIwOWMwYmEtNTVhOC00NDExLThkZDktYzllODk1NmZlNDQ0" method="POST" name="pareq_form"> <input type="hidden" name="PaReq" value="eJxVUst22jAQ/RUfL7rpMZKFiQ0dK4dXgAVOTmuSpjvVGsApfkSWA+TrK/Fo0t29M6M7M3cEt4di57yhavKqjF2/Q10Hy6ySebmJ3VV650Wu02hRSrGrSozdIzbuLYd0qxAnPzBrFXJYYtOIDTq5jN1aCIEioyzywkhILwh7gddnFD1JMVyv

15HfYz2Xw8PwO75yuPTmpnWHAblSo6myrSg1B5G9jhYJD266jHWBXCgUqBYTPk4fR4+M+jdAzgEoRYG8zrXGRn+dFb/nz

hdR1N+ccQXklIOsakutjpyF5tWVQKt2fKt1PSBkv993sqqoW13VHYlAbA7Ix0gPrUWN0Trkkv+aLVnyvjkuZ6tD8vS8Ty

a7l/unBXt+n8ZAbAVIoZGbMSPaY4HjB4MuHQR9IKc4iMIOwX1KzXpnDLVtMfyU+BwA47sydzryfhiZHa4M8FCbM5kKY+U/DBKbjKfGD9PQQiAfC4zn1uFMG+vm+V06bad/Zi+rn6rrJ20xWt4P49h6fiqw8rnxyo/8s74lQKwEuZyTXP6CQf/9kb8b1MvQ"> <input type="hidden" name="TermUrl" value="http://localhost:40405/test/3DTermURL.aspx?PayID=dc67820e15f049c9b6c1f0420729da8a&TransID=20180524-162741-084&MID=gustav"> <input type="hidden" name="MD" value="Optional merchant session data"> </form> </body> </html>

Once the authentication has been completed or the cancelled by the cardholder the ACS will redirect the cardholder through the cardholder’s browser to the TermURL as specified in the initail payment request.

Notice: The Payer Authentication Response (PaRes) will be transferred via HTTP POST method while MID, PayID and TransID are sent in the HTTP query string (i.e. HTTP GET).

Data Elements transferred to the TermURL

| Key | Format | Condition | Description |

| MID | ans..30 | M | MerchantID, assigned by First Cash Solution. |

| PayID | ans32 | M | ID assigned by the 1cs Online Payment System for the payment, e.g. for referencing in batch files as well as for capture or credit request. |

| TransID | ans..64 | M | TransactionID provided by you which should be unique for each payment |

| PARes | — | M | The PARes (Payer Authentication Response) message sent by the ACS in response to the PAReq regardless of whether authentication is successful. |

2.3.2 Authorization

In order to authorize an 3DS 1.0 authenticated payment you must POST the parameter as listed in the table below unencrypted to https://www.computop-paygate.com/direct3d.aspx. The response always is encrypted (Len + Data).

Request Elements

| Key | Format | Condition | Description |

| MerchantID | ans..30 | M | MerchantID, assigned by First Cash Solution. Additionally this parameter has to be passed in plain language too. |

| PayID | ans32 | M | ID assigned by the 1cs Online Payment System for the payment, e.g. for referencing in batch files as well as for capture or credit request. |

| TransID | ans..64 | M | TransactionID provided by you which should be unique for each payment |

| PAResponse | — | M | The PARes (Payer Authentication Response) message sent by the ACS. |

Response Elements

| Key | Format | Condition | Description |

| MID | ans..30 | M | MerchantID assigned by First Cash Solution. |

| PayID | an32 | M | ID assigned by the 1cs Online Payment System for the payment, e.g. for referencing in batch files as well as for capture or credit request. |

| XID | an32 | M | ID for all single transactions (authorisation, capture, credit note) for one payment assigned by the 1cs Online Payment System |

| TransID | ans..64 | M | TransactionID provided by you which should be unique for each payment |

| Status | a..20 | M | Staus of the transaction. Values accepted: Authorized OK (Sale) FAILED |

| Description | ans..1024 | M | Textual description of the code |

| Code | n8 | M | the 1cs Online Payment System response code |

| card | JSON | C | Card data |

| ipInfo | JSON | O | Object containing IP information |

| threeDSData | JSON | M | Authentication data |

2.3.2.1 Payer Authentication Request Message Fields

The Payer Authentication Request (PAReq) message field is a data element constructed by First Cash Solution’s Merchant Server Plug-in (MPI).

The MPI builds the XML PAReq, in canonical format according to the DTD. It passes the XML stream to an RFC1951-compliant compressor, which produces an RFC1950-compliant output stream which turn is Base64 encoded.

For eductaional purposes the PAReq data elements are listed in the table below.

PAReq

| Data Eelement | CND | Description |

| Message Version Number | M | Message Version Number as received in the Verify Enrollment Response (VERes). Values accepted: 1.0.1 1.0.2 |

| Acquirer Bank Identification Number (BIN) | M | This field must match the acquirer BIN used in the Verify Enrollment Request. |

| Merchant Identifier (ID) Number | M | This field must match the Merchant ID used in the Verify Enrollment Request. This field also must match the Merchant ID used by the acquirer with the card networks for authorizations and clearing. |

| Merchant Name | M | This field must contain the name of the online merchant at which cardholder is making the purchase. The maximum length is 25 characters. The merchant name must match the name submitted for authorization and clearing. |

| Merchant Country Code | M | This field must contain the ISO 3166 three digit country code value. |

| Merchant URL | M | This field must contain the fully qualified URL of the merchant site. |

| Transaction Identifier | M | Unique transaction identifier determined by merchant. Contains a 20 byte statistically unique value that has been Base64 encoded, giving a 28 byte result. |

| Purchase Date & Time | M | Date and time of purchase expressed in GMT in the following format: YYYYMMDD HH:MM:SS. |

| Purchase Amount | M | This field must contain the value of the purchase being made by the cardholder. It is a value up to 12 digits with punctuation removed. |

| Purchase Currency | M | The appropriate ISO 4217 three-digit currency code for the transaction currency between the cardholder and merchant must be used. |

| Currency Exponent | M | The minor units of currency as defined in ISO 4217. |

| Order Description | O | Brief description of items purchased, determined by the merchant. Maximum size is 125 characters, but merchant should consider the characteristics of the cardholder’s device when creating the field. |

| Recurring Payment Data | C | A Recur element must be included if the merchant and cardholder have agreed to recurring payments. |

| Installment Payment Data | C | An integer greater than one indicating the maximum number of permitted authorizations for installment payments. Must be included if the merchant and cardholder have agreed to installment payments. |

| Account Identifier | M | The content of this field is a data string useful to the ACS; it must not reveal the PAN and must be generated using an algorithm that is likely to generate unique values, even if the same PAN is being presented. |

| Card Expiry Date | M | Expiration Date supplied to merchant by cardholder (YYMM). |

| Message Extension | O | Any data necessary to support the requirements that are not otherwise defined in the PAReq message must be carried in an instance of Message Extension. |

| Recurring Payment Data | ||

| Recurring Frequency | M | An integer indicating the minimum number of days between authorizations. |

| Recurring Expiry | M | The date after which no further authorizations should be performed. (YYYYMMDD format). |

2.4 Silent Order Post (PayNow)

2.4.1 Overview

A Silent Order Post or Direct Post is a transmission method where form data from a merchant website are getting directly posted to a third-party server. This is commonly achieved through the formaction attribute that specifies the URL the data are sent to.

Notice: Sensitive data such as card details can be captured within a merchant’s website without being processed by the merchant server as the POST is submitted silently. The URL endpoint in the 1cs Online Payment System to receive Silent Order Post requests is referred to as PayNow.

<form action=”../payNow.aspx” method=”post”>

This approach is very similar to First Cash Solution hosted payment forms and leaves the merchant in full control of the checkout experience as all website elements are delivered from the merchant’s server.

PCI-DSS Considerations: Merchants processing card transactions using the Silent Post model must submit the PCI DSS Self-Assessment Questionnaire (SAQ) A-EP. This SAQ is more comprehensive and thus might require more time and resources in comparison to SAQ A applicable to merchants that use hosted payment pages. However, merchants should always consult with their acquirer to evaluate the level of compliance required and refer to the PCI DSS guidelines. This does not affect the use of pseudo card numbers which is possible without submitting the SAQ questionaire.

Notice about Cookie-/Session Handling: about Cookie-/Session Handling: Please note that some browsers might block necessary cookies when returning to Your shop. Here you will find additial information and different solution approaches.

Sequence Diagram

2.4.2 Payment Request

Please POST the form data as outlined in table below to https://www.computop-paygate.com/payNow.aspx.

Form elements

| Data Element | Legacy Element | Description |

| MerchantID | — | Merchant identifier assigned by First Cash Solution. |

| Len | — | The length of the original encrypted with Blowfish. |

| Data | — | Blowfish encrypted data. |

| number | CCNr | Card number. |

| securityCode | CCCVC | Card security value. |

| expiryDate | CCExpiry | Card expiry in format YYYYMM. |

| brand | CCBrand | Card network. |

| cardholder | CreditCardHolder | Name of the cardholder as printed on the card. Notice: Alphanumeric special characters, listed in EMV Book 4, “Appendix B”. Special characters have been added with EMV 3DS Version 2.3, but not all participants (banks) already support that standard. |

(- First Cash Solution will continue to support the legacy form data fields that are currently in use. -)

Data

| Key | Format | Condition | Description |

| MerchantID | ans..30 | M | MerchantID assigned by First Cash Solution. Additionally this parameter has to be passed in plain language too. |

| TransID | ans..64 | M | TransactionID provided by you which should be unique for each payment |

| MsgVer | ans..5 | M | Message version. Accepted values: 2.0 |