Direct debit

1.1 General information about direct debit

1.1.1 Process of a direct debit payment on the Internet

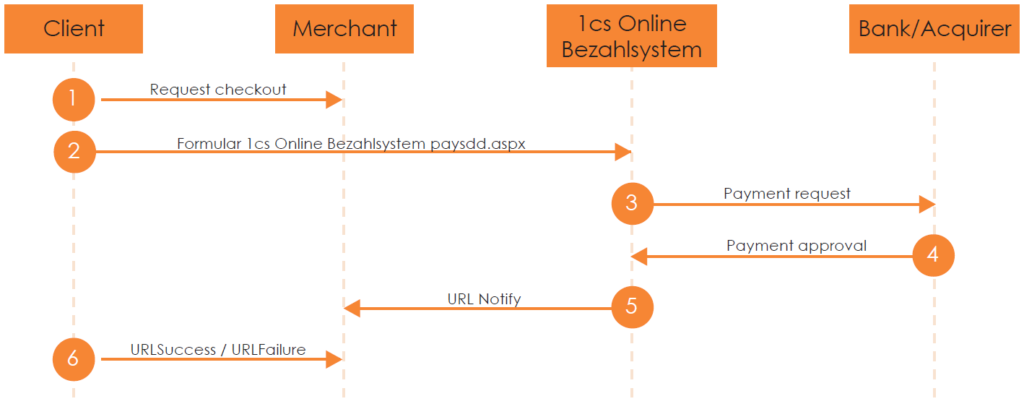

2 1cs Online Payment System interface: via form

2.1 Chart of process flow via form interface

2.3.7 Link to the 1cs OPS logo

2.3.8 Programming and testing the form

2.4 General parameters of the interface

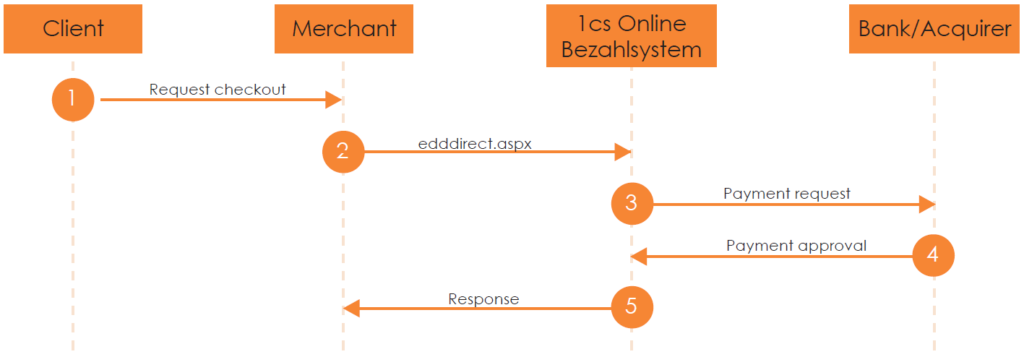

3 1cs Online Payment System interface: via Server-to-Server

3.1 Chart of process flow via Server-to-Server

3.2 Calling the interface: general parameters

1 About direct debit

1.1 General information about direct debit

The 1cs Online Payment System can combine electronic direct debits (ELV) in Germany with a block list check which offers high security at low cost: the 1cs Online Payment System checks if the Customer’s account number is black listed by major retailers. Additionally, you can prevent fraud by setting sales limits per day, week or month which an account connection may not exceed.

Since there are substantially more accounts than credit cards, many Internet purchases are paid by direct debit. The direct debit process is unsafe for merchants without a block list check: in the case of SEPA direct debits there is no authorisation because it is not possible to carry out a credit rating on the account of the customer. Therefore there are frequently returned debit notes in the case of ELV due to lack of funds in accounts.

The block list check links the benefits of the direct debit with the security of a block list check and individual sales limits.

Transaction procedure of a direct debit payment on the Internet

In order to pay with a direct debit, the customer selects the Direct debit payment method at the Internet checkout and enters their account details. This Internet page is TLS encrypted to protect the account data during the transmission against tapping and manipulation. After the input the 1cs Online Payment System checks if the account is blocked and if the sales limit for this account has been reached. After successful verification, the 1cs Online Payment System draws direct debits from the customer’s bank.

SEPA direct debit

With SEPA uniform rules for cashless payment transactions are effective since 1st February 2014. Therefore IBAN (International Bank Account Number) and BIC (Bank Identifier Code) are used as account data. With the 1cs Online Payment System direct debits can be managed compliant to SEPA.

Time frames for chargebacks

Depending on the SEPA Mandate form there are different time frames during which the customer can trigger a chargeback.

• Authorised SEPA Mandates (at the POS with PIN/signature): maximum time frame during which the end-customer can trigger a return debit/chargeback is 8 weeks from the payment date.

• Unauthorised SEPA Mandates (eCommerce payments): maximum time frame during which the end-customer can trigger a return debit/chargeback is 13 months from the payment date.

Logo

| Info | Type |

| The 1cs Online Payment System enables you to handle the direct debit payment method popular with customers –and is fully compatible with SEPA. Optionally with black list check and payment guarantee. | Payments by Direct Debit |

2 1cs Online Payment System interface: via form

2.1 Chart of process flow via form interface

Process flow of direct debit payment via form interface

2.2 Online Payment System interface: Definitions

2.2.1 Data formats

| Format | Description |

| a | alphabetical |

| as | alphabetical with special characters |

| n | numeric |

| an | alphanumeric |

| ans | alphanumeric with special characters |

| ns | numeric with special characters |

| bool | boolean expression (true or false) |

| 3 | fixed length with 3 digits/characters |

| ..3 | variable length with maximum 3 digits/characters |

| enum | enumeration of allowed values |

| dttm | ISODateTime (YYYY-MM-DDThh:mm:ss) |

2.2.2 Abbreviations

| Abbreviation | Description | Comment |

| CND | condition | |

| M | mandatory | If a parameter is mandatory, then it must be present |

| O | optional | If a parameter is optional, then it can be present, but it is not required |

| C | conditional | If a parameter is conditional, then there is a conditional rule which specifies whether it is mandatory or optional |

Notice: Please note that the names of parameters can be returned in upper or lower case.

2.3 Corporate PayPage

The 1cs Online Payment System forms are framed as standard in white and grey. Merchants can customise the layout of the forms with the help of layout parameters. The simplest way to change the layout is to set the parameters for the background colour (BGColor), background image (BGImage) and the font (FFace). You can use XSL-templates to change the layout further:

In the case of direct debit payments you can change the parameter Template to create an individual layout for your PaySDD-form which exactly matches your shop layout. To this end your graphic designer can design an HTML-template in the shop-design based on XSLT (Extensible Stylesheet Language Transformation). First Cash Solution Support copies this XSLT-template to our the 1cs Online Payment System Server. If you enter the name of your XSLT-file in the Template parameter, the 1cs Online Payment System form will appear in your layout.

For general information about XSLT see www.w3.org.

The subsequent conventions apply for the use of the Corporate Pay Page with XSLT:

2.3.1 File names

A XSL file designed by you defines your individual layout. The associated XML file contains the texts that are to be displayed on the form. Hence, multilingualism is easy. Always use your MerchantID in the names of the files.

XSL template: MerchantID_PaySDD.xsl

XML text file: MerchantID_PaySDD.xml

Sub-folder for images: Templates/imagesMerchantID

In order not to receive safety notices, please ensure that external image sources are retrieved via SSL.

In order to call the individual layout, use the ‘template’ parameter with your MerchantID and attach it unencrypted to the call of the First Cash Solution payment page, for example: https://www.computop-paygate.com/paysdd.aspx?MerchantID=IhreMID&Len=123&Data=ABCFED…ACEF&template=IhreMerchantID

2.3.2 Field names of the form

When implementing the text field for the IBAN, use the following values for the parameters ‘name’ and ‘id’:

Account holder: „AccOwner“

IBAN: „IBAN“

BIC: „BIC“

Bank (optional): „AccBank“

A text field for the input of the IBAN is then implemented as follows:

<input type=”text” name=”IBAN” id= “IBAN” value=””></input>

2.3.3 Hidden Fields

The following hidden fields must be implemented so that the values can be passed on when sending the form:

MerchantID: „MerchantID“

Request length: „Len“

Request data: „Data“

Template: „Template“

Language: „Language“

2.3.4 Language selection

The language selection in form PaySDD.aspx is automatically based on the parameter Language. Other language areas are filtered out. If you wish to access the field of another language area e.g. with JavaScript, you can do so via the following path: template/language/@name.

2.3.5 XML structure

The ‘language’ parameter controls which section of the XML text file is read out. German ‘de’ is always used as standard.

The XML file should have the following basic structure:

<?xml version="1.0" encoding="UTF-16"?> </languages> <language name="de"> </language> <language name="en"> </language> </languages>

With <xsl:variablename=““ select=“template/language/@name”/> you can directly address an XML language section from the XSL file.

For an overview of which parameters are rendered by the PaySDD, please examine the following structure (XSL file is rendered against the following XML string):

Dim strXML As String = "<?xml version='1.0' encoding='UTF-16'?>" & _ "<template pay='elv'>" & _ "<merchantID>"..."</merchantID>" & _ "<PayID>"..."</PayID>" & _ "<len>"..."</len>" & _ "<data>"..."</data>" & _ "<language>"..."</language>" & _ "<Border>"..."</Border>" & _ "<Background>"..."</Background>" & _ "<BGImage>"..."</BGImage>" & _ "<BGColor>"..."</BGColor>" & _ "<FFace>"..."</FFace>" & _ "<FSize>"..."</FSize>" & _ "<FColor>"..."</FColor>" & _ "<twidth>"..."</twidth>" & _ "<theight>"..."</theight>" & _ strCustomFieldsXML & _ "<URLBack>"..."</URLBack>" & _ "<AccOwner>"..."</AccOwner>" & _ "<IBAN>"..."</IBAN>" & _ "<PBAN>"..."</PBAN>" & _ "<BIC>"..."</BIC>" & _ "<Bank>"..."</Bank>" & _ "<template>"..."</template>" & _ "</template>"

Since merchants use its own layout for the form, you do not require the layout parameter. However, it is possible after prior consultation with First Cash Solution to use the parameters for the transfer, e.g. the SessionID.

2.3.6 JavaScript

If JavaScript functions are desired, you must implement them in your template.

<script id=“clientEventHandlersJS“ language=“JavaScript“>

if (document.SDDForm.IBAN.value.length > 34) { alert(„<xsl:value-of select=“/template/language/strJavaScript1“/>“); document.SDDForm.IBAN.focus(); } ... </script>

Please do not use any external link to your JavaScript.

2.3.7 Link to the 1cs Online Payment System logo

We are obliged to provide the account holder information on which server he is on. Please implement a the 1cs OPS logo like it is implemented on the standard form or display a small imprint link. You can download the 1cs OPS logo from www.computop.de/downloads.

Both items of information must refer to the 1cs OPS page impressum.aspx. This expects the ‘Data’ parameter, which is appended to the URL as in the following example.

impressum.aspx?data=<xsl:value-of select=”/template/language/@name”/>|<xsl:value-of select=”template/merchantID”/>

2.3.8 Programming and testing the form

First design a HTML page with the layout for your payment page and initially save it for testing with the file extension .htm or .html. Open this file in the browser. Next, save this as an xsl file.

<?xml version='1.0' encoding="UTF-16"?> <xsl:stylesheet version="1.0" xmlns:xsl="http://www.w3.org/1999/XSL/Transform"> <xsl:output method="html" encoding="UTF-8"/> <xsl:template match="/"> <html> <head> <title>PaySDD Template</title> <script>Your JavaScript</script> </head> <body> <form action="https://www.computop-paygate.de/payinterim.aspx" methode="POST">

Your form with hidden fields and xsl-tags </form> </body> </html> </xsl:template>

In order to read the texts from the XML file, first of all create your tags in the desired language sections with the texts:

<language name="de">

<strIBAN>IBAN</strIBAN> </language>

Subsequently, replace the text in the HTML by a reference to the respective section in the XML file:

<xsl:value-of select="/template/language/strIBAN"/>

In order to test your template, we request that you integrate the following lines in your XML file only for the test (before sending it to First Cash Solution) and afterwards to call up the XML file in a browser. If no error is displayed, you can send your template and the image folder in a Zip file to First Cash Solution’s Support with a request to check and install it.

<?xml version="1.0" encoding="UTF-16"?> <?xml-stylesheet type="text/xsl" href="templatename.xsl"?> <template> <languages>please omit for your layout tests <language name="de"> </language> <language name="en"> </language> <languages>please omit for your layout tests </template>

In order to get an overview of the versions, please include the date and version number in the name of your Zip file.

2.4 General parameters of the interface

The interface of the 1cs Online Payment System form is consistently paysdd.aspx for all connections. In order to make a direct debit payment via the 1cs Online Payment System form, go to the following URL:

This section explains the parameters which are the same for each connection. These values are always required, along with the special parameters explained in the following sections for each individual connection. The second table explains all response parameters which are also the same for all direct debit connections.

Notice: For security reasons, the 1cs Online Payment System rejects all payment requests with formatting errors. Therefore, please use the correct data type for each parameter.

The following table describes the encrypted payment request parameters:

| Key | Format | CND | Description |

| MerchantID | ans..30 | M | MerchantID, assigned by First Cash Solution. Additionally, this parameter must be passed in plain language too. |

| MAC | an64 | M | Hash Message Authentication Code (HMAC) with SHA-256 algorithm. Details can be found here: HMAC Authentication (Request) HMAC Authentication (Notify) |

| TransID | ans..64 | M | TransactionID which should be unique for each payment When using auto-mandate (filling-in of MandateID with TransID or RefNr) the permitted character set is that of the MandateID parameter. |

| Amount | n..10 | M | Amount in the smallest currency unit (e.g. EUR Cent) Please contact the helpdesk, if you want to capture amounts < 100 (smallest currency unit). |

| Currency | a3 | M | Currency, three digits DIN / ISO 4217, e.g. EUR, USD, GBP. Please find an overview here: A1 Currency table EN |

| URLSuccess | ans..256 | M | Complete URL which calls up the 1cs Online Payment System if payment has been successful. The URL may be called up only via port 443 This URL may not contain parameters: In order to exchange values between the 1cs Online Payment System and shop, please use the parameter UserData. Common notes: We recommend to use parameter “response=encrypt” to get an encrypted response by the 1cs Online Payment System However, fraudster may just copy the encrypted DATA-element which are sent to URLFailure and send the DATA to URLSuccess. Therefore ensure to check the “code”-value which indicates success/failure of the action. Only a result of “code=00000000” should be considered successful. |

| URLFailure | ans..256 | M | Complete URL which calls up the 1cs Online Payment System if payment has been unsuccessful. The URL may be called up only via port 443 This URL may not contain parameters: In order to exchange values between the 1cs Online Payment System and shop, please use the parameter UserData. Common notes: We recommend to use parameter “response=encrypt” to get an encrypted response by the 1cs Online Payment System. However, fraudster may just copy the encrypted DATA-element which are sent to URLFailure and send the DATA to URLSuccess/URLNotify. Therefore ensure to check the “code”-value which indicates success/failure of the action. Only a result of “code=00000000” should be considered successful. |

| Response | a7 | O | Status response sent by the 1cs Online Payment System to URLSuccess and URLFailure, should be encrypted. For this purpose, transmit Response=encrypt parameter. |

| URLNotify | ans..256 | M | Complete URL which the 1cs Online Payment System calls up in order to notify the shop about the payment result. The URL may be called up only via port 443 It may not contain parameters: Use the UserData parameter instead. Common notes: We recommend to use parameter “response=encrypt” to get an encrypted response by the 1cs Online Payment System However, fraudster may just copy the encrypted DATA-element which are sent to URLFailure and send the DATA to URLSuccess/URLNotify. Therefore ensure to check the “code”-value which indicates success/failure of the action. Only a result of “code=00000000” should be considered successful. |

| In case of a direct debit payment and in the event of incorrect entries by the customer, one or more retries can be made directly on the 1cs OPS form. The peculiarity here is that per payment attempt the shop receives a URLNotify call directly after execution. For that reason it is possible that the shop can receive e.g. 3 Notifies with an identical PayID and thereby different statuses can occur which must be processed accordingly. | |||

| UserData | ans..1024 | O | If specified at request, the 1cs Online Payment System forwards the parameter with the payment result to the shop |

| Capture | an..6 | OM | Determines the type and time of capture. AUTO: capturing immediately after authorisation (default value). MANUAL: capturing made by the merchant. <Number>: Delay in hours until the capture (whole number; 1 to 696). |

| ReqID | ans..32 | O | To avoid double payments, enter an alphanumeric value which identifies your transaction and may be assigned only once. If the transaction is submitted again with the same ReqID, the 1cs Online Payment System will not carry out the payment, but will just return the status of the original transaction. Please note that the 1cs OPS must have a finalized transaction status for the first initial action. Submissions with identical ReqID for an open status will be processed regularly. Notice: Please note that a ReqID is only valid for 12 month, then it gets deleted at the 1cs Online Payment System. |

| expirationTime | ans..19 | O | timestamp for the end time of the transaction processing, specified in UTC. Format: YYYY-MM-ddTHH:mm:ss |

| Plain | ans..50 | O | A value to be set by the merchant to return some information unencrypted, e.g. the MID. “Plain”-parameter is part of encrypted “Data” in the 1cs OPS and therefore protected against manipulation. |

| Custom | ans..1024 | O | “Custom”-parameter is added to the request data before encryption and is part of encrypted “Data” in the 1cs Online Payment System request. By this they are protected against manipulation by a consumer. The Custom-value is added to the 1cs Online Payment System response in plain text and the “|” is replaced by a “&”. By this you can put a single value into Custom-parameter and get multiple key-value-pairs back in response for your own purpose. |

General parameters for direct debit payments via form

To adapt the layout of the SSL-page to your shop you can use the following unencrypted parameters to configure colours, fonts and images:

| Key | Format | CND | Description |

| AccBank | ans..20 | O | for the pre-completion of the direct debit form: Name of the account holder’s bank |

| AccOwner | ans..50 | O | for the pre-completion of the direct debit form: Name of account holder |

| IBAN | ans..34 | M | for the pre-completion of the SEPA form: International Bank Account Number |

| BIC | ans..11 | O | for the pre-completion of the SEPA form: Bank Identifier Code |

| Language | a2 (enum) | M | Language code: <de> German, <al> Albanian, <at> Austrian, <cz/cs> Czech, <dk> Danish, <en> English, <fi> Finish, <fr> French, <gr> Greek, <hu> Hungarian, <it> Italian, <jp> Japanese, <nl> Dutch, <no> Norwegian, <pl> Polish, <pt> Portuguese, <ro> Romanian, <ru> Russian, <sp> Spanish, <se> Swedish, <sk> Slovakian, <sl> Slovenian, <tr> Turkey, <zh> Simplified Chinese. No details means the language is German. |

| Template | ans..20 | O | Name of XSLT-file with your own layout for the pay form. If you want to use the redesigned and downwards compatible First Cash Solution template, please transfer the template name “ct_compatible”. If you want to use the responsive First Cash Solution template for mobile devices, please transfer the template name “ct_responsive”. |

| Background | ans..256 | O | Background ambiance of form: URL for a background image – HTML-colour value for background colour as HEX value or – HTML-colour name |

| BGColor | ans..7 | O | – HTML-colour value for background colour as HEX value or – HTML-colour name |

| BGImage | ans..256 | O | Form background image: URL for a background image Please note that this value supersedes “BGColor”. |

| FColor | ans..7 | O | Text colour: – HTML-colour value as HEX value or – HTML-colour name |

| FFace | a..10 | O | HTML-name for the font |

| FSize | n2 | O | Number for font size |

| URLBack | ans..256 | O | Complete URL which 1cs OPS calls in case that Cancel is clicked by the customer. The parameter “URLBack” can be sent either as plain parameter (unencrypted) (compatibility mode) or be part of encrypted payment request parameters (preferred mode) In order to exchange values between the 1cs Online Payment System and shop you may use something like this: URLBack=https://your.shop.com/back.php?param1%3Dvalue1%26param2%3Dvalue3%26status%3Dcancelled When user cancels payment this URL is called exactly like this and you may use URL Decode to extract parameter and values. |

| tWidth | ans..4 | O | Width of table for input of the direct debit data as percent- (50%) or pixel values (320). |

| tHeight | ans..4 | O | Height of table for input of the direct debit data as percent- (70%) or pixel values (480). |

| CustomField[n] | ans..50 | O | Merchants can customize up to 14 special fields (called CustomField1 to CustomField14) on their payment form template. CustomFields are a feature that allows you to show additional information such as your logo, order details and customer details on the payment form. Special characters (like &, ‘, <, >) are not allowed – even not “urlencoded”. The usage / display of CustomField{n] depends on the template that is used. |

Layout parameters for 1cs OPS forms for direct debit payments

The following table gives the result parameters which the 1cs Online Payment System transmits to URLSuccess or URLFailure and URLNotify. If you have specified the Response=encrypt parameter, the following parameters are sent Blowfish encrypted to your system:

![]() be prepared to receive additional parameters at any time and do not check the order of parameters

be prepared to receive additional parameters at any time and do not check the order of parameters

![]() the parameters (e.g. MerchantId, RefNr) should not be checked case-sentive

the parameters (e.g. MerchantId, RefNr) should not be checked case-sentive

| Key | Format | CND | Description |

| MID | ans..30 | M | MerchantID, assigned by First Cash Solution |

| PayID | an32 | M | ID assigned by the 1cs Online Payment System for the payment, e.g. for referencing in batch files as well as for capture or credit request. |

| XID | an32 | M | ID for all single transactions (authorisation, capture, credit note) for one payment assigned by the 1cs Online Payment System |

| TransID | ans..64 | M | TransactionID provided by you which should be unique for each payment |

| Status | a..50 | M | OK or PENDING (URLSuccess) as well as FAILED (URLFailure) |

| Description | ans..1024 | M | Further details in the event that payment is rejected. Please do not use the Description but the Code parameter for the transaction status analysis! |

| Code | n8 | M | Error code according to the 1cs Online Payment System Response Codes Excel file |

| MAC | an64 | M | Hash Message Authentication Code (HMAC) with SHA-256 algorithm. Details can be found here: HMAC Authentication (Request) HMAC Authentication (Notify) |

| UserData | ans..1024 | O | If specified at request, the 1cs Online Payment System forwards the parameter with the payment result to the shop |

| IBAN | ans..34 | OC | only without PBAN configuration: International Bank Account Number |

| BIC | ans..11 | O | Bank Identifier Code |

| AccOwner | ans..50 | O | Name of account holder |

| AccBank | ans..20 | O | Name of the financial institute of the account holder |

| Plain | ans..50 | O | A value to be set by the merchant to return some information unencrypted, e.g. the MID. “Plain”-parameter is part of encrypted “Data” in the 1cs Online Payment System and therefore protected against manipulation. |

| Custom | ans..1024 | O | “Custom”-parameter is added to the request data before encryption and is part of encrypted “Data” in the 1cs Online Payment System request. By this they are protected against manipulation by a consumer. The Custom-value is added to the 1cs Online Payment System response in plain text and the “|” is replaced by a “&”. By this you can put a single value into Custom-parameter and get multiple key-value-pairs back in response for your own purpose. |

| CustomField(IN) | ans..50 | O | Merchants can customize up to 14 special fields (called CustomField1 to CustomField14) on their payment form template. CustomFields are a feature that allows you to show additional information such as your logo, order details and customer details on the payment form. Special characters (like &, ‘, <, >) are not allowed – even not “urlencoded”. The usage / display of CustomField{n] depends on the template that is used. |

General results parameters for URLNotify, URLSuccess and URLFailure

2.5 Direct connection

In addition to the general parameters described above for the direct debit connection the fol-lowing parameters need to be transmitted via form. The following table describes the encrypted payment request parameters:

| Key | Format | CND | Description |

| Refnr | ns..30 | O | Merchant’s unique reference number Only ASCII characters are allowed. Special characters such as (“umlauts”, …) are not permitted and may have to be replaced by ASCII characters (e.g. ü → ue, é → e, …). |

| OrderDesc | ans..384 | M | Description of purchased goods, unit prices etc. The first 27 characters appear on the customer-account statement. You can view the full data in the 1cs Online Payment System Analytics. |

| OrderDesc2 | ans..384 | M | 2. Goods description which appears on the account extract (27 characters). You can view the full data in the Merchant Backend. |

| Capture | ans..6 | O | Determines the type and time of capture. AUTO: capturing immediately after authorisation (default value). MANUAL: capturing made by the merchant. <Number>: Delay in hours until the capture (whole number; 1 to 696). |

| MandateID | ans..35 | C | for SEPA: SEPA mandate number (compulsory in the case of SEPA) should be unique, is not case-sensitive Permissible characters: numbers 0-9, upper case letters A-Z, lower case letters a-z, apostrophe, colon, question mark, comma, full stop, plus sign, minus sign, forward slash, left and right bracket |

| DtOfSgntr | ans..10 | O | for SEPA: Date of issuing the mandate in the format DD.MM.YYYY (obligatory when transferring the MandateID) |

| MdtSeqType | a4 | O | for SEPA: Indicates whether the direct debit is a first, recurring, one-off or final direct debit. Permissible values: FRST, RCUR, OOFF, FNAL Standard: OOFF (single direct debit) |

| PBAN | ans..27 | O | for SEPA: PseudoBankNumber. The last three digits are identical to the last three digits of the IBAN number |

Additional parameters for the direct debit connection via the 1cs OPS form

The following table gives the result parameters whichthe 1cs OPS transmits to URLSuccess or URLFailure and URLNotify. If you have specified the Response=encrypt parameter, the following parameters are sent Blowfish encrypted to your system:

![]() be prepared to receive additional parameters at any time and do not check the order of parameters

be prepared to receive additional parameters at any time and do not check the order of parameters

![]() the parameters (e.g. MerchantId, RefNr) should not be checked case-sentive

the parameters (e.g. MerchantId, RefNr) should not be checked case-sentive

| Key | Format | CND | Description |

| refnr | ns..30 | O | Merchant’s unique reference number Only ASCII characters are allowed. Special characters such as (“umlauts”, …) are not permitted and may have to be replaced by ASCII characters (e.g. ü → ue, é → e, …). |

| MandateID | ans..35 | O | for SEPA: SEPA mandate number (compulsory in the case of SEPA) should be unique, is not case-sensitive Permissible characters: numbers 0-9, upper case letters A-Z, lower case letters a-z, apostrophe, colon, question mark, comma, full stop, plus sign, minus sign, forward slash, left and right bracket |

| DtOfSgntr | ans..10 | O | for SEPA: Date of issuing the mandate in the format DD.MM.YYYY (obligatory when transferring the MandateID) |

| MdtSeqType | ans..4 | O | for SEPA: Indicates whether the direct debit is a first, recurring, one-off or final direct debit. Permissible values: FRST, RCUR, OOFF, FNAL Standard: OOFF (single direct debit) |

| PBAN | ans..27 | O | for SEPA: PseudoBankNumber. The last three digits are identical to the last three digits of the IBAN number |

Additional result parameters for URLNotify, URLSuccess and URLFailure in case of direct connection

3 1cs Online Payment System interface: via Server-to-Server

3.1 Chart of process flow via Server-to-Server

For the server-to-server payment processes please refer to the programming basics manual.

Process flow of a direct debit payment via server-to-server interface

3.2 Call of interface: general parameters

The interface for direct debit payments is edddirect.aspx for all connections. To carry out an electronic direct debit via a Server-to-Server connection, call the following URL:

Notice: For security reasons, the 1cs Online Payment System rejects all payment requests with formatting errors. Therefore, please use the correct data type for each parameter.

The following table describes the encrypted payment request parameters:

| Key | Format | CND | Description |

| MerchantID | ans..30 | M | MerchantID, assigned by First Cash Solution. Additionally, this parameter must be passed in plain language too. |

| Amount | n..10 | M | Amount in the smallest currency unit (e.g. EUR Cent) Please contact the helpdesk, if you want to capture amounts < 100 (smallest currency unit). |

| Currency | a3 | M | Currency, three digits DIN / ISO 4217, e.g. EUR, USD, GBP. Please find an overview here: A1 Currency table EN |

| MAC | an64 | M | Hash Message Authentication Code (HMAC) with SHA-256 algorithm. Details can be found here: HMAC Authentication (Request) HMAC Authentication (Notify) |

| TransID | ans..64 | M | TransactionID which should be unique for each payment When using auto-mandate (filling-in of MandateID with TransID or RefNr) the permitted character set is that of the MandateID parameter. |

| UserData | ans..1024 | O | If specified at request, the 1cs Online Payment System forwards the parameter with the payment result to the shop |

| AccBank | ans..20 | M | Bank name |

| AccOwner | a..50 | M | Account holder |

| IBAN | ans..34 | M | International Bank Account Number |

| BIC | ans..11 | O | Bank Identifier Code |

| ReqID | ans..32 | O | To avoid double payments, enter an alphanumeric value which identifies your transaction and may be assigned only once. If the transaction is submitted again with the same ReqID, the 1cs Online Payment System will not carry out the payment, but will just return the status of the original transaction. Please note that the 1cs OPS must have a finalized transaction status for the first initial action. Submissions with identical ReqID for an open status will be processed regularly. Notice: Please note that a ReqID is only valid for 12 month, then it gets deleted at the 1cs OPS. |

| UserData | ans..256 | O | If specified at request, the 1cs Online Payment System forwards the parameter with the payment result to the shop |

| Capture | ans..6 | OM | Determines the type and time of capture. AUTO: capturing immediately after authorisation (default value). MANUAL: capturing made by the merchant. <Number>: Delay in hours until the capture (whole number; 1 to 696). |

General parameters for direct debit payments via socket connection

The following table gives the result parameters which the 1cs Online Payment System transmits to URLSuccess or URLFailure and URLNotify. If you have specified the Response=encrypt parameter, the following parameters are sent Blowfish encrypted to your system:

- be prepared to receive additional parameters at any time and do not check the order of parameters

- the parameters (e.g. MerchantId, RefNr) should not be checked case-sentive

| Key | Format | CND | Description |

| MID | ans..30 | M | MerchantID, assigned by First Cash Solution |

| PayID | an32 | M | ID assigned by the 1cs Online Payment System for the payment, e.g. for referencing in batch files as well as for capture or credit request. |

| XID | an32 | M | ID for all single transactions (authorisation, capture, credit note) for one payment assigned by the 1cs Online Payment System |

| TransID | ans..64 | M | TransactionID provided by you which should be unique for each payment |

| Status | a..50 | M | OK or PENDING (URLSuccess) as well as FAILED (URLFailure) |

| Description | ans..1024 | M | Further details in the event that payment is rejected. Please do not use the Description but the Code parameter for the transaction status analysis! |

| Code | n8 | M | Error code according to the 1cs Online Payment System Response Codes Excel file |

| UserData | ans..1024 | O | If specified at request, the 1cs Online Payment System forwards the parameter with the payment result to the shop |

| IBAN | ans..34 | O | International Bank Account Number |

| BIC | ans..11 | OC | Only in the case of PBAN creation: PseudoBankNumber. The last three digits are identical to the last three digits of the IBAN number |

| AccOwner | ans..50 | OC | Only in the case of PBAN creation: Account holder |

| AccBank | ans..20 | OC | Only in the case of PBAN creation: Name of the bank |

| PBAN | ans..27 | O | Only in the case of PBAN creation: PseudoBankNumber. The last three digits are identical to the last three digits of the IBAN number |

| MandateID | ans..35 | O | SEPA mandate number |

| DtOfSgntr | ans..10 | O | Registration date of granting mandate in the format DD.MM.YYYY |

General response parameters for direct debit payments via socket connection

3.3 Direct connection

Besides the general parameters described above for the direct debit connection, the following parameters are to be transmitted via server-to-server connection.

The following table describes the encrypted payment request parameters:

| Key | Format | CND | Description |

| MandateID | ans..35 | M | for SEPA: SEPA mandate number (compulsory in the case of SEPA) should be unique, is not case-sensitive Permissible characters: numbers 0-9, upper case letters A-Z, lower case letters a-z, apostrophe, colon, question mark, comma, full stop, plus sign, minus sign, forward slash, left and right bracket |

| DtOfSgntr | ans..10 | O | for SEPA: Date of issuing the mandate in the format DD.MM.YYYY (obligatory when transferring the MandateID) |

| MdtSeqType | ans..4 | O | for SEPA: Indicates whether the direct debit is a first, recurring, one-off or final direct debit. Permissible values: FRST, RCUR, OOFF, FNAL Standard: OOFF (single direct debit) |

| PBAN | ans..27 | O | for SEPA: PseudoBankNumber. The last three digits are identical to the last three digits of the IBAN number |

| Code | an8 | M | Error code according to the 1cs OPS Response Codes (A4 Error codes) |

| UserData | ans..1024 | O | If specified at request, 1cs Online Payment forwards the parameter with the payment result to the shop. |

| RefNr | ns..30 | O | Merchant’s unique reference numberOnly ASCII characters are allowed. Special characters such as (“umlauts”, …) are not permitted and may have to be replaced by ASCII characters (e.g. ü → ue, é → e, …). |

| OrderDesc | ans..384 | M | Description of purchased goods, unit prices etc. The first 27 characters appear on the customer-account statement. You can view the full data in 1cs Analytics. |

| OrderDesc2 | ans..384 | M | 2. Goods description which appears on the account extract (27 characters). You can view the full data in the 1cs OPS Analytics. |

| Additional parameters in case of activated DEVICERECOGNITION | |||

| DeviceID | ans..50 | O | Unique Device-ID |

| DRConfidence | n..3 | O | Allocation quote 0-100 (0=no allocation, 100=absolutely safe allocation |

| DRNewDevice | ans..5 | O | True / false |

| DRAnonProxyUsed | ans..5 | O | True / false |

| DRProxyUsed | ans..5 | O | True / false |

| DRCountryCode | a2 | O | Country code, 2 characters according to ISO 3166, retrieved from geolocation data, e.g. DE |

| DRCity | ans..50 | O | City, retrieved form geolocation data, e.g. Frankfort |

| DRLatitude | ans..50 | O | Geographic latitude, retrieved from geolocation data, e.g. 13.754 |

| DRLongitude | ans..50 | O | Geographic longitude, retrieved from geolocation data, e.g. 100.5014 |

| DRFS | n..3 | O | Fraud score 0-100 (0=low fraud probability, 100=high fraud probability) |

| DRFSRulematch | ans..1024 | O | Rules for allocation to fraud score |

| DRBrowserLanguages | ans..255 | O | List of browser languages |

| DRIsMobileDevice | ans..5 | O | True / false |

| Fraud | ans..50 | O | e.g. Fraud, Suspicion, NoFraud |

Additional parameters for direct debit payments via socket connection for the direct connection

The following table gives the parameters with which the 1cs Online Payment System responds:

| Key | Format | CND | Description |

| refnr | ns..30 | O | Merchant’s unique reference number Only ASCII characters are allowed. Special characters such as (“umlauts”, …) are not permitted and may have to be replaced by ASCII characters (e.g. ü → ue, é → e, …). |

| MdtSeqType | ans..4 | O | for SEPA: Indicates whether the direct debit is a first, recurring, one-off or final direct debit. Permissible values: FRST, RCUR, OOFF, FNAL Standard: OOFF (single direct debit) |

Additional response parameters for direct debit payments via socket connection for the direct connection

4 Capture / Credit / Reversal

4.1 Capture

Captures are possible via a Server-to-Server connection. To perform a capture via a Server-to-Server connection please use the following URL:

Notice: Separate captures are not possible with the PPRO connection because all transactions are carried out directly as sale transactions.

Notice: For security reasons, the 1cs Online Payment System rejects all payment requests with formatting errors. Therefore, please use the correct data type for each parameter.

The following table describes the encrypted payment request parameters:

| Key | Format | CND | Description |

| MerchantID | ans..30 | M | MerchantID, assigned by First Cash Solution. Additionally, this parameter must be passed in plain language too. |

| PayID | an32 | M | ID assigned by the 1cs Online Payment System for the payment to be captured |

| TransID | ans..64 | M | ID assigned by Merchant for the payment process to be captured |

| MAC | an64 | M | Hash Message Authentication Code (HMAC) with SHA-256 algorithm. Details can be found here: HMAC Authentication (Request) HMAC Authentication (Notify) |

| Amount | n..10 | M | Amount in the smallest currency unit (e.g. EUR Cent) Please contact the helpdesk, if you want to capture amounts < 100 (smallest currency unit). |

| Currency | a3 | M | Currency, three digits DIN / ISO 4217, e.g. EUR, USD, GBP. Please find an overview here: A1 Currency table EN |

| RefNr | ns..30 | M | Merchant’s unique reference number Only ASCII characters are allowed. Special characters such as (“umlauts”, …) are not permitted and may have to be replaced by ASCII characters (e.g. ü → ue, é → e, …). |

| ReqID | ans..32 | O | To avoid double payments, enter an alphanumeric value which identifies your transaction and may be assigned only once. If the transaction is submitted again with the same ReqID, 1cs OPS will not carry out the payment, but will just return the status of the original transaction. Please note that the 1cs OPS must have a finalized transaction status for the first initial action. Submissions with identical ReqID for an open status will be processed regularly. Notice: Please note that a ReqID is only valid for 12 month, then it gets deleted at the 1cs Online Payment System. |

| MandateID | ans..35 | O | for SEPA: SEPA mandate number (compulsory in the case of SEPA) should be unique, is not case-sensitive Permissible characters: numbers 0-9, upper case letters A-Z, lower case letters a-z, apostrophe, colon, question mark, comma, full stop, plus sign, minus sign, forward slash, left and right bracket |

| DtOfSgntr | ans..10 | O | for SEPA: Date of issuing the mandate in the format DD.MM.YYYY (obligatory when transferring the MandateID) |

Parameters for captures of direct debit payments

The following table describes the result parameters with which the 1cs online payment system responds to your system

- be prepared to receive additional parameters at any time and do not check the order of parameters

- the parameters (e.g. MerchantId, RefNr) should not be checked case-sentive

| Key | Format | CND | Description |

| MID | ans..30 | M | MerchantID, assigned by First Cash Solution |

| PayID | an32 | M | ID assigned by the 1cs Online Payment System for the payment, e.g. for referencing in batch files as well as for capture or credit request. |

| XID | an32 | M | ID for all single transactions (authorisation, capture, credit note) for one payment assigned by the 1cs Online Payment System |

| TransID | ans..64 | M | TransactionID provided by you which should be unique for each payment |

| Status | a..50 | M | OK (URLSuccess) or FAILED (URLFailure) |

| Description | ans..1024 | M | Further details in the event that payment is rejected. Please do not use the Description but the Code parameter for the transaction status analysis! |

| Code | n8 | M | Error code according to the 1cs Online Payment System Response Codes Excel file |

| RefNr | ns..30 | O | Merchant’s unique reference number Only ASCII characters are allowed. Special characters such as (“umlauts”, …) are not permitted and may have to be replaced by ASCII characters (e.g. ü → ue, é → e, …). |

Response parameters for captures of direct debit payments

4.2 Credit with reference

Credits (refunds) are possible via a Server-to-Server connection. The 1cs Online Payment System permits credits which relate to a capture previously activated by the 1cs Online Payment System and allows merchants to carry out credits without a reference transaction. This section describes the processing of credits with reference transactions. If you refer to a capture for a Credit, the amount of the Credit is limited to the amount of the previous capture.

To carry out a credit with a reference transaction, please use the following URL:

Notice: For security reasons, the 1cs Online Payment System rejects all payment requests with formatting errors. Therefore, please use the correct data type for each parameter.

The following table describes the encrypted payment request parameters:

| Key | Format | CND | Description |

| MerchantID | ans..30 | M | MerchantID, assigned by First Cash Solution. Additionally, this parameter must be passed in plain language too. |

| PayID | an32 | M | ID assigned by the 1cs Online Payment System for the payment to be credited |

| TransID | ans..64 | M | ID assigned by Merchant for the payment process to be credited |

| MAC | an64 | M | Hash Message Authentication Code (HMAC) with SHA-256 algorithm. Details can be found here: HMAC Authentication (Request) HMAC Authentication (Notify) |

| RefNr | ns..30 | C | not with EVO: Merchant’s unique reference number Only ASCII characters are allowed. Special characters such as (“umlauts”, …) are not permitted and may have to be replaced by ASCII characters (e.g. ü → ue, é → e, …). |

| Amount | n..10 | M | Amount in the smallest currency unit (e.g. EUR Cent) Please contact the helpdesk, if you want to capture amounts < 100 (smallest currency unit). |

| Currency | a3 | M | Currency code, three digits DIN / ISO 4217, Please find an overview here: Currency table |

| ReqID | ans..32 | O | To avoid double payments, enter an alphanumeric value which identifies your transaction and may be assigned only once. If the transaction is submitted again with the same ReqID, 1cs OPS will not carry out the payment, but will just return the status of the original transaction. Please note that the 1cs OPS must have a finalized transaction status for the first initial action. Submissions with identical ReqID for an open status will be processed regularly. Notice: Please note that a ReqID is only valid for 12 month, then it gets deleted at the 1cs Online Payment System. |

Parameters for credits of direct debit payments

The following table describes the result parameters with which the 1cs online payment system responds to your system

- be prepared to receive additional parameters at any time and do not check the order of parameters

- the parameters (e.g. MerchantId, RefNr) should not be checked case-sentive

| Key | Format | CND | Description |

| MID | ans..30 | M | MerchantID, assigned by First Cash Solution |

| PayID | an32 | M | ID assigned by the 1cs Online Payment System for the payment to be credited |

| XID | an32 | M | ID for all single transactions (authorisation, capture, credit note) for one payment assigned by the 1cs Online Payment System |

| TransID | ans..64 | M | TransactionID provided by you which should be unique for each payment |

| Status | a..50 | M | OK (URLSuccess) or FAILED (URLFailure) |

| Description | ans..1024 | M | Further details in the event that payment is rejected. Please do not use the Description but the Code parameter for the transaction status analysis! |

| Code | n8 | M | Error code according to the 1cs Online Payment System Response Codes Excel file |

| RefNr | ns..30 | C | Merchant’s unique reference number Only ASCII characters are allowed. Special characters such as (“umlauts”, …) are not permitted and may have to be replaced by ASCII characters (e.g. ü → ue, é → e, …). |

Response parameters for credits of direct debit payments

4.3 Credit without reference

The 1cs Online Payment System can carry out Credits which do not relate to a previous capture. In this case the credit must be transferred to the 1cs Online Payment System as a completely new payment transaction. Please contact the First Cash Solution Helpdesk for help in using the described additional functions.

Notice: Please note that credits without reference to a previous capture generate higher costs with your Acquiring Bank. If you are frequently unable to make reference to the capture you should agree this with your Acquiring Bank.

Notice: Credit without reference is only possible with a direct debit connection.

To carry out a Credit without a reference transaction via a Server-to-Server connection, please use the following URL:

Notice: For security reasons, the 1cs Online Payment System rejects all payment requests with formatting errors. Therefore, please use the correct data type for each parameter.

The following table describes the encrypted payment request parameters:

| Key | Format | CND | Description |

| MerchantID | ans..30 | M | MerchantID, assigned by First Cash Solution. Additionally, this parameter must be passed in plain language too. |

| TransID | ans..64 | M | TransactionID which should be unique for each payment |

| RefNr | ns..30 | O | Merchant’s unique reference number Only ASCII characters are allowed. Special characters such as (“umlauts”, …) are not permitted and may have to be replaced by ASCII characters (e.g. ü → ue, é → e, …). |

| Amount | n..10 | M | Amount in the smallest currency unit (e.g. EUR Cent) Please contact the helpdesk, if you want to capture amounts < 100 (smallest currency unit). |

| Currency | a3 | M | Currency, three digits DIN / ISO 4217, e.g. EUR, USD, GBP. Please find an overview here: A1 Currency table EN |

| AccOwner | ans..50 | OC | Only in the case of PBAN creation: Account holder |

| AccBank | ans..20 | OC | Only in the case of PBAN creation: Name of the bank |

| IBAN | ans..34 | O | International Bank Account Number |

| BIC | ans..11 | OC | Only in the case of PBAN creation: PseudoBankNumber. The last three digits are identical to the last three digits of the IBAN number |

| OrderDesc | ans..768 | M | Description of refunded goods, unit prices, merchant’s comment etc. |

| ReqID | ans..32 | O | To avoid double payments, enter an alphanumeric value which identifies your transaction and may be assigned only once. If the transaction is submitted again with the same ReqID, the 1cs Online Payment System will not carry out the payment, but will just return the status of the original transaction. Please note that the 1cs Online Payment System must have a finalized transaction status for the first initial action. Submissions with identical ReqID for an open status will be processed regularly. Notice: Please note that a ReqID is only valid for 12 month, then it gets deleted at the 1cs Online Payment System. |

| MAC | an64 | M | Hash Message Authentication Code (HMAC) with SHA-256 algorithm. Details can be found here: HMAC Authentication (Request) HMAC Authentication (Notify) |

Parameters for credits of direct debit payments without reference

The following table describes the result parameters with which the 1cs online payment system responds to your system

- be prepared to receive additional parameters at any time and do not check the order of parameters

- the parameters (e.g. MerchantId, RefNr) should not be checked case-sentive

| Key | Format | CND | Description |

| MID | ans..30 | M | MerchantID, assigned by First Cash Solution |

| PayID | an32 | M | ID assigned by the 1cs Online Payment System for the payment, e.g. for referencing in batch files as well as for capture or credit request. |

| XID | an32 | M | ID for all single transactions (authorisation, capture, credit note) for one payment assigned by the 1cs Online Payment System |

| TransID | ans..64 | M | TransactionID provided by you which should be unique for each payment |

| Status | a..50 | M | OK (URLSuccess) or FAILED (URLFailure) |

| Description | ans..1024 | M | Further details in the event that payment is rejected. Please do not use the Description but the Code parameter for the transaction status analysis! |

| Code | n8 | M | Error code according to the 1cs Online Payment System Response Codes Excel file |

Response parameters for credits of direct debit payments without reference

4.4 Reversal

Reversals are possible via a Server-to-Server connection. In order to cancel a direct debit payment via a server-to-server communication, go to the following URL:

Notice: Reverse.aspx does not only reverse authorisations, but any LAST TRANSACTION STAGE! If the last transaction was a capture, Reverse.aspx initiates the reverse, e.g. a credit. Therefore, the utmost caution is urged. Use is at your own risk. We recommend checking the transaction status with Inquire.aspx before using Reverse.aspx.

Notice: Cancellation is only possible with a direct debit connection.

Notice: For security reasons, the 1cs Online Payment System rejects all payment requests with formatting errors. Therefore, please use the correct data type for each parameter.

The following table describes the encrypted payment request parameters:

| Key | Format | CND | Description |

| MerchantID | ans..30 | M | MerchantID, assigned by First Cash Solution. Additionally, this parameter must be passed in plain language too. |

| PayID | an32 | M | The 1cs Online Payment System ID for the identification of a payment |

| TransID | ans..64 | M | ID assigned by Merchant for the payment process to be reversed |

| Amount | n..10 | M | Amount in the smallest currency unit (e.g. EUR Cent) Please contact the helpdesk, if you want to capture amounts < 100 (smallest currency unit). |

| Currency | a3 | M | Currency, three digits DIN / ISO 4217, e.g. EUR, USD, GBP. Please find an overview here: A1 Currency table EN |

| MAC | an64 | M | Hash Message Authentication Code (HMAC) with SHA-256 algorithm. Details can be found here: HMAC Authentication (Request) HMAC Authentication (Notify) |

| ReqId | ans..32 | O | To avoid double payments / actions, enter an alphanumeric value which identifies your transaction and may be assigned only once. If the transaction / action is submitted again with the same ReqID, 1cs OPS will not carry out the payment or new action, but will just return the status of the original transaction / action. Please note that the 1cs OPS must have a finalized transaction status for the first initial action. Submissions with identical ReqID for an open status will be processed regularly. Notice: Please note that a ReqID is only valid for 12 month, then it gets deleted at the 1cs OPS. |

Parameters for reversals of direct debit payments

The following table describes the result parameters with which the 1cs online payment system responds to your system

- be prepared to receive additional parameters at any time and do not check the order of parameters

- the parameters (e.g. MerchantId, RefNr) should not be checked case-sentive

| Key | Format | CND | Description |

| MID | ans..30 | M | MerchantID, assigned by First Cash Solution |

| PayID | an32 | M | ID assigned by the 1cs Online Payment System for the payment, e.g. for referencing in batch files as well as for capture or credit request. |

| XID | an32 | M | ID for all single transactions (authorisation, capture, credit note) for one payment assigned by the 1cs Online Payment System |

| TransID | ans..64 | M | TransactionID provided by you which should be unique for each payment |

| Status | a..50 | M | OK (URLSuccess) or FAILED (URLFailure) |

| Description | ans..1024 | M | Further details in the event that payment is rejected. Please do not use the Description but the Code parameter for the transaction status analysis! |

| Code | n8 | M | Error code according to the 1cs Online Payment System Response Codes Excel file |

Response parameters for reversals of direct debit payments

5 Batch processing via the interface

Basic information about using Batch files and about their structure can be found in the Batch Manager manual. Within batch processing not alle functions are available which are usually available for the online interface.

5.1 Batch calls and answers

This section describes the parameters which must be transferred within the data set (Record) for executing a direct debit payment and which information can be found within the response file about the payment status.

The possible actions per batch depend on the respective connection. In the case of direct connections and via b4payment all transactions including credit without reference are possible while cancellation and credit without reference are not possible with EVO Payment, InterCard and PPRO connections. In the case of PPRO the transactions are also purely sales transactions and so only sales and credit is possible here. BACS payments with b4payment are not possible via Batch.

Following table gives an overview of all batch versions that are possible for a specific action and their specialities:

| Action | Version | Description |

| Capture | 1.0 / 2.0 | Standard version without return of parameter Code |

| 1.x / 2.x | with RefNr (valid for all versions other than 1.0) | |

| Authorize | 1.0.1 / 2.0.1 | Standard version without return of parameter Code |

| 1.x.1 / 2.x.1 | with RefNr (valid for all versions other than 1.0) | |

| Sale | 1.0.1 / 2.0.1 | Standard version without return of parameter Code |

| 1.x.1 / 2.x.1 | with RefNr (valid for all versions other than 1.0) | |

| Credit | 1.0 / 2.0 | Standard version without return of parameter Code |

| 1.x / 2.x | with RefNr (valid for all versions other than 1.0) | |

| CreditEx | 1.0 / 2.0 | Standard version without return of parameter Code |

| 1.x / 2x. | with RefNr (valid for all versions other than 1.0) |

Description of the possible batch versions

The structure for a direct debit payment within a Batch file to be submitted is the following:

HEAD,<MerchantID>,<Date>,<Version>

EDD,Authorize,<Amount>,<Currency>,<TransID>,(<RefNr>,)<AccOwner>,<IBAN>,<BIC>,<AccBankName>,<OrderDesc1>,<OrderDesc2>,(<MandateID>,<DtOfSgntr>,<MdtSeqType>)

EDD,Sale,<Amount>,<Currency>,<TransID>,(<RefNr>,)<AccOwner>,<IBAN>,<BIC>,<AccBankName>,<OrderDesc1>,<OrderDesc2>,(<MandateID>,<DtOfSgntr>,<MdtSeqType>)

EDD,Capture,<Amount>,<Currency>,<TransID>,(<RefNr>,)<PayID>,(<MandateID>,<DtOfSgntr>,<MdtSeqType>)

EDD,Credit,<Amount>,<Currency>,<TransID>,(<RefNr>,)<PayID>

EDD,CreditEx,<Amount>,<Currency>,<TransID>,(<RefNr>,)<AccOwner>,<IBAN>,<BIC>,<AccBankName>,<OrderDesc1>,<OrderDesc2>

EDD,Reverse,<Amount>,<Currency>,<TransID>,(<RefNr>,)<PayID>

FOOT,<CountRecords>,<SumAmount>

Example for Master MID Funktion:

HEAD,[Master]MerchantID,Date,2.x

Type,Action,[Slave]MID,Amount,Currency,TransID,Data (depends on Action) FOOT,CountRecords,SumAmount

The following table describes the individual fields and values used within the data set (record) in the batch file:

| Key | Format | CND | Description |

| Type | a..11 | M | HEAD for Header, FOOT for Footer, EDD for direct debit |

| Action | a..20 | M | The parameter Action defines the type of transaction: Authorize (authorisation) Capture Sale Credit CreditEx (credit note without previous capture; please agree this with First Cash Solution Support beforehand) Reverse (cancellation) |

| Amount | n..10 | M | Amount in the smallest currency unit (e.g. EUR Cent) Please contact the helpdesk, if you want to capture amounts < 100 (smallest currency unit). |

| Currency | a3 | M | Currency, three digits DIN / ISO 4217, e.g. EUR, USD, GBP. Please find an overview here: A1 Currency table EN |

| TransID | ans..63 | M | TransactionID which should be unique for each payment |

| PayID | an32 | M | ID assigned by the 1cs Online Payment System for this transaction |

| RefNr | ns..30 | O | Unique reference number Only ASCII characters are allowed. Special characters such as (“umlauts”, …) are not permitted and may have to be replaced by ASCII characters (e.g. ü → ue, é → e, …). |

| AccOwner | ans..50 | M | Account holder |

| IBAN | ans..34 | M | International Bank Account Number |

| BIC | ans..11 | O | Bank Identifier Code |

| AccBankName | ans..20 | M | Name of the bank |

| OrderDesc1 | ans..27 | M | Text explaining customer account withdrawal, max. 27 characters |

| OrderDesc2 | ans..27 | M | Text explaining customer account withdrawal, max. 27 characters (2. line) |

| MandateID | ans..35 | O | SEPA mandate number (compulsory in the case of SEPA) should be unique, is not case-sensitive Permissible characters: numbers 0-9, upper case letters A-Z, lower case letters a-z, apostrophe, colon, question mark, comma, full stop, plus sign, minus sign, forward slash, left and right bracket |

| DtOfSgntr | ans..10 | O | Date of issuing the mandate in the format DD.MM.YYYY (obligatory when transferring the MandateID) |

| MdtSeqType | a4 | O | Indicates whether the direct debit is a first, recurring, one-off or final direct debit. Permissible values: FRST, RCUR, OOFF, FNAL Standard: OOFF (single direct debit) |

Description of fields within the record for Batch files

The record area within the response file for Batch transactions looks as follows:

HEAD,<MerchantID>,<Date>,<Version>

EDD,Authorize,<Amount>,<Currency>,<TransID>,(<RefNr>,)<AccOwner>,<IBAN>,<BIC>,<AccBankName>,<OrderDesc1>,<OrderDesc2>,(<MandateID>,<DtOfSgntr>,<MdtSeqType>,)<Status>,<Code>

EDD,Sale,<Amount>,<Currency>,<TransID>,(<RefNr>,)<AccOwner>,<IBAN>,<BIC>,<AccBankName>,<OrderDesc1>,<OrderDesc2>,(<MandateID>,<DtOfSgntr>,<MdtSeqType>,)<Status>,<Code>

EDD,Capture,<Amount>,<Currency>,<TransID>,(<RefNr>,)<PayID>,(<MandateID>,<DtOfSgntr>,<MdtSeqType>,)<Status>,<Code>

EDD,Credit,<Amount>,<Currency>,<TransID>,(<RefNr>,)<PayID>,<Status>,<Code>

EDD,CreditEx,<Amount>,<Currency>,<TransID>,(<RefNr>,)<AccOwner>,<IBAN>,<BIC>,<AccBankName>,<OrderDesc1>,<OrderDesc2>,<Status>,<Code>

EDD,Reverse,<Amount>,<Currency>,<TransID>,(<RefNr>,)<PayID>,<Status>,<Code>

FOOT,<CountRecords>,<SumAmount>

The following table describes the response parameters which the Batch Manager saves in the Record area for each transaction (standard parameters not explained here, such as <TransID> or <RefNR> and request parameters are returned unchanged and correspond to the call as specified before):

| Key | Format | CND | Description |

| Action | a..20 | M | The parameter Action defines the type of transaction like capture or credit – see above. |

| PayID | an32 | M | ID assigned by the 1cs Online Payment System for the payment, e.g. for referencing in batch files as well as for capture or credit request. |

| Status | a..50 | M | OK (URLSuccess) or FAILED (URLFailure) |

| Code | n8 | M | Error code according to the 1cs Online Payment System Response Codes Excel file |

Description of result parameters within the record for Batch files